0.6900 becomes a very important level once again

10th September:

"Sometimes a market or trend just plain runs out of steam and gets to the point where it can do no more for the time being. Maybe the reasons have changed or they lose strength but once you get that change in mindset that usually means the short term picture has changed

These moves do not put an official stamp on AUDUSD that the trend is over. What it does do is say is that we may consolidate or that the short term path is back up. The longer term trend remains intact while the bigger topside levels remain far away

For now reloading shorts for anything longer than an intraday trade could be the riskier trade and longs from the low 0.70's may be the better play. For longer term traders patience is more likely to be required. Sit back and let the market show you what it wants to do. Watch the higher key levels and use the action against them to decide whether the time is right to add or initiate shorts

Of course, tomorrow, in 5 minutes, in 2 days, we could be trading at 0.68 on some event or another and this post becomes toilet paper. That's not the point. The point is that for now I see something different in the price action and that something is enough to pay close attention to as it could mean the difference between making or losing money"

From that post AUDUSD ran up another 200 odd pips before turning tail

This isn't a post of me boasting. I want to highlight the fact that whatever your thoughts are on a country, an economy, a central bank or whoever, we should always be guided by price action first and foremost.

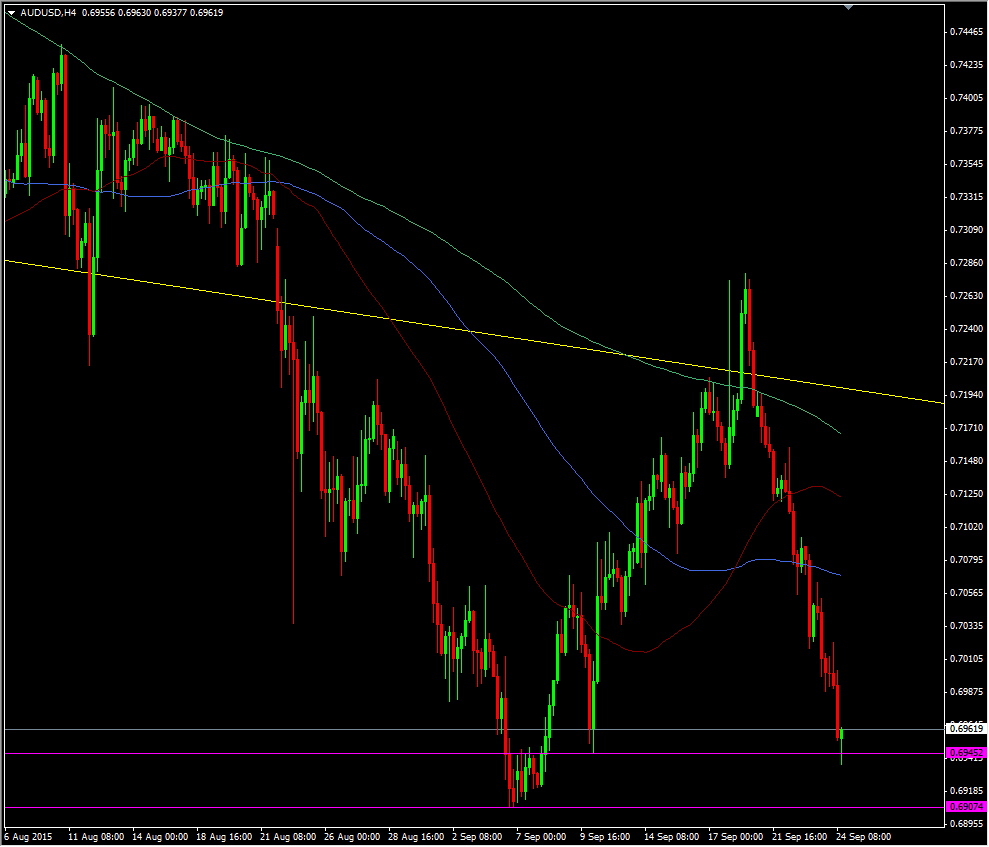

AUDUSD has now broken what I saw as the first line of defence ahead of the 0.6907 lows in early Sep

AUDUSD H4 chart

The break through the 0.6940/50 area hasn't been clean, nor was it confirmed, so the level still holds some significance

Shorts may have used the bounce to let off some steam and gather their thoughts for the next push lower. On that front it's probably apt to link to my post from 2nd Sep: Is it time for the Aussie to really probe the downside?

The reason is that the views I had then are still firmly in place now and the fact we've come back so quickly heightens the prospect that we do see another big shift to the downside

My thoughts are just that, so I'll let the price do the talking. Break 0.6900 and off we go. Hold and we'll see a bounce, but again be cautious on how far it may go. If it goes no higher than say around 0.7200 then we're likely to get a third look at 0.69, and you know my thoughts on a price testing a level repeatedly

The battle at 0.6900 is on