By Boris Schlossberg at BK Forex

Right after last week's column, I got an interesting email from a long time reader and in order to fully appreciate its value I am going to something I never do. I am going to quote his email in full.

He wrote, (quoting me)" 'In short Las Vegas, is basically a multi-billion dollar bet on the fact that you are incapable of an early exit, and that's certainly reason enough to believe that it's a good strategy.'

Lets flip it around. We know that all (if not most) casinos make lots of money consistently. But casinos never stop taking bets & that means they don't & never exit. They can lose 20 hands in a row to a full table of blackjack/baccarat players but cannot & would not stop play. No matter how many bets or how large the bets are (subject to table limits) are placed the casino will accept the bets & continue dealing the cards. So basically zero exit strategy even when the casino is going through a huge & extended losing streak. But in the end, long term, they still come up tops by the billions.

So how do they do it? One of the reasons is that every game the casino offers has an inbuilt edge that ensures long term profitability.

Applying this 'casino model' to trading, if you (ie any trader) have an inbuilt edge in your trading strategy/approach can't you then go on trading without early exits & come out tops long term ie be the casino? If you can't then does that mean your trading strategy/approach doesn't have an inbuilt edge & you therefore have to rely on 'early exit' as your 'edge'?I would very much appreciate your thoughts on this."

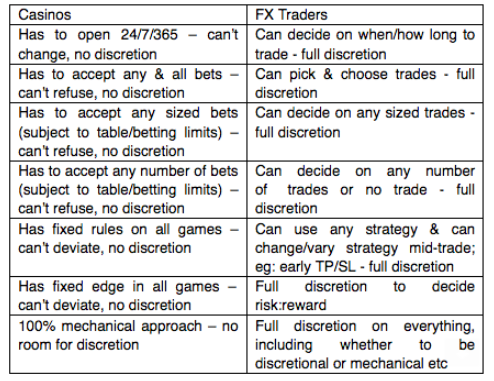

He then included a very useful table of comparison that I am attaching as well.

Certainly his logic is highly seductive and he concludes with final pointed criticism of my approach, "So why do casinos still win in the end year in year out? Why do traders (99%) fail? And among those traders who win - their wins are nowhere close to the casinos' profits (billions).

Is discretion killing traders? Should traders be more mechanical? Even continuing to trade despite long losing streaks?

Unlike the 'insurance model' which takes many small wins & a few large losses, casinos take all small losses, all large losses, all small wins, & all large wins. And they win in the end - big time."

This is the argument of highly mechanistic traders and in principle it certainly sounds superior to my hunt-and-peck-make-3-pips-and-a-cloud-of-dust method of getting rich slowly and carefully. In practice however, it is not. Let's start with the underlying foundation of the casino model.

The game is RIGGED. By definition you cannot win at casino games. The rules are such that odds, no matter how small are always stacked against you. Casinos have absolute control because they control the rules of the game and create a fully closed end system. They know as surely as day follows night, as certain as death and taxes that given enough occurrences they will always win, because they have the edge -- because they MANUFACTURED that edge.

Alas, no such certainty exists in the financial markets. Markets are the exact opposite of casinos. They are an open end system where the edge is always fluid and always changing. No system is certain for any length of time. The best example of that in my life occurred very early my career, when as a young broker at Drexel Burnham I helped raise money for commodity fund run by Richard Dennis. Dennis was considered to be a trading god, a man who was one of the original Turtles who was profiled in Market Wizards as the king of trend trading, a man who took $200 and turned it into $100 Million. After we raised money for him Dennis proceeded to lose almost all the funds trading worse than the most rookie retail trader I've ever seen. When it was all over he lost something like $75 Million in a matter of months. Why? Because he was stupid enough to believe that he had a permanent edge. In reality, the great boom in commodity prices was over and trend trading failed to work for more than three decades after that.

You know doesn't believe in permanent edge? Insurance companies. They, better than anyone, understand that life evolves and changes. They constantly research, constantly adapt and constantly change their products. For example in the 1970's it was a no brainer to sell annuities because most people died of smoking-related illness or cancer and the actuarial table hugely favored in the sellers. But the odds have changed, Better medicine, less smoking and healthier lifestyle have extended the lifespan considerably, so you better believe that insurance companies are not going to "trade that strategy" anymore.

That I think is my answer in a nutshell.

Casino model is highly seductive because it is static. All you need to win is to repeat the algorithm ad infinitum. Real world is the farthest thing from being static. It is dynamic, always evolving and always demanding reevaluation of your assumptions on a near daily basis. That's why the insurance model is the much better path for traders. Both casinos and insurance companies rely on the law of large numbers, but that's where the similarity ends and to believe that your edge is stable much less permanent is to fall for a Richard Dennis scale of folly.