Trade recommendation stopped out

Yesterday, Adam posted a trade idea from HSBC to sell the AUDJPY at 85.37, with a profit target of 80.58 and a stop at 86.58. So risk was about 120 pips and reward was about 480 pips. That conveniently comes to a 4:1 reward to risk ratio. Enticing trade idea even if the risk reward seems a bit contrived.

Here was the rationale behind the trade:

There was not much said technically about the trade. The fundamental reasons were that the RBA would push back against the currency and tighter financial conditions as a result of the higher currency. In addition, they expected greater risk aversion, i.e., stocks declining, maybe geopolitical tensions. I can see that. Terms of trade are important for Australia during a time when uncertainty from China is a threat to their export market. They probably don't want it to get worse. As far as risk aversion, stocks have been on a run higher. Perhaps they are coming due for a correction.

Adam's chart shows the pair has been confined in a non trending range. Non trending transitions to trending in my book. So a move one way or the other could be anticipated.

BUT.....

My concern with the trade, was "Were there a technical reason or reasons to sell and was the risk limited?".

As mentioned the daily chart was showing consolidation. When that occurs, I like to drill down and see what a shorter time frame chart is saying. If the charts are turning negative or bearish, great. The price does not lie. It may fail, but it tells you what "the market" is leaning towards that bias. It also shows - via tools - where risk can be defined and therefore, limited.

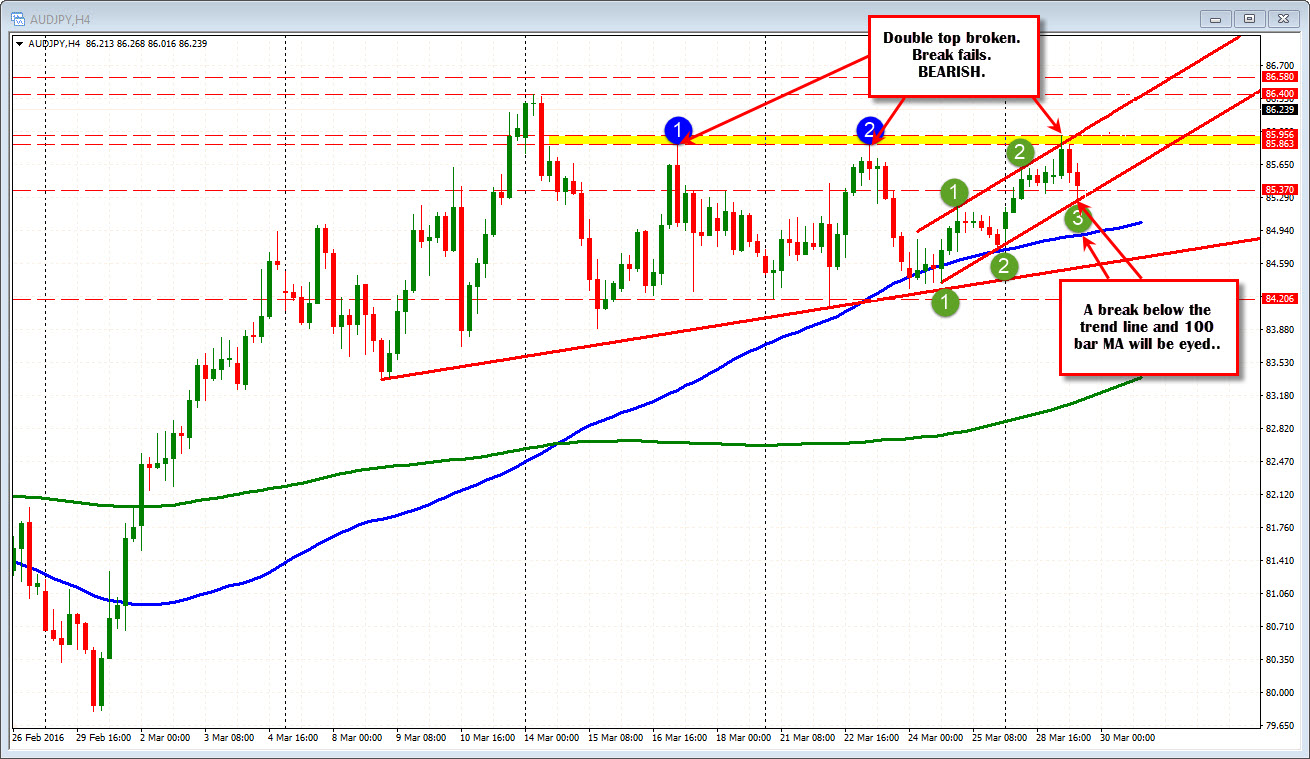

So if I looked at the 4-hour chart, this is what I would have seen as the trade was being put on at 85.37.

What do I see?

- The price failed on the break of the recent highs on March 17 and March 23. That is bearish...Good (see 1 and 2 circles on the chart below)

- The price is testing trend line support (see lower trend line at green circle 3).

- The price has been above the 100 bar MA on the 4-hour chart since the beginning of the month. Yes, there were 5 bars where the price traded below the MA line (see blue line) on March 24th, but there were no closes below the line and the momentum certainly was not to the downside on those breaks (in fact the price could not reach the lowest trend line).

The trade was to sell just above that trend line at 85.37.

Would I have done the trade?

Honestly, I cannot fault the short trade idea on the grounds that the double top break failed. I cannot fault the idea, that the non trend might transition to trend. I can fault the trade on where the trade was executed. It makes more sense to wait for the break and sell lower, than to sell just above the trend line support. They should have waited.

What about risk?

Let's say you could not help yourself and you did the trade anyway. Does risk need to be all the way up at 86.58 given this price action in the 4-hour chart? Was risk being limited?

For me with a failure at the double top, a move above that level would be enough for me. The reason is that - remember - the daily chart showed non trending. Non trending will transition to trending at some point. If the support holds and the double top is ultimately broken, I would anticipate a potential for a break higher not lower. Sure the fundamental story does not fit the price action, but the price action and tools applied to the price action are saying "Bullish" not "Bearish". PS if you don't like the fundamental story, simply don't trade if it goes higher.

So what happened?

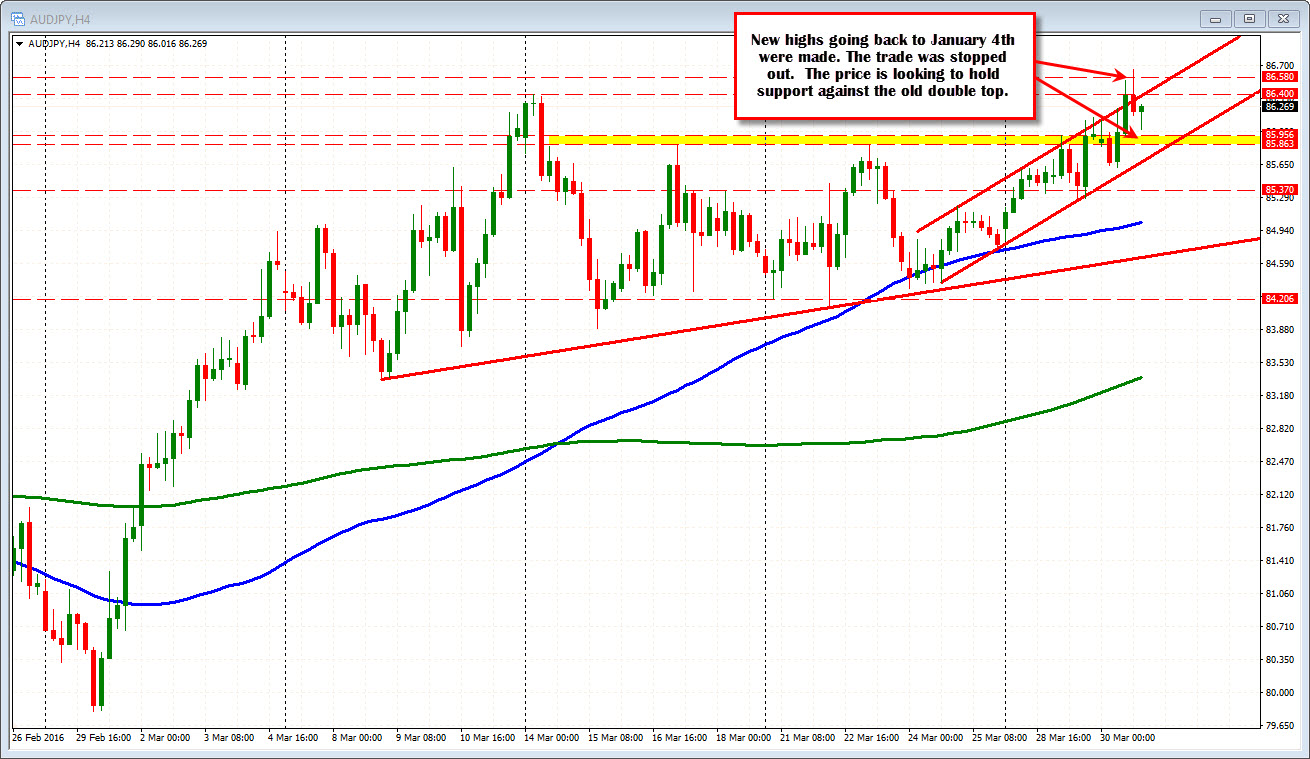

The price moved higher - helped by a rising stock market (so no risk aversion). The stop was triggered at 86.58. The price has since reversed back to the old double top and failed break area. Traders have just bought against that support level. The hope it the price breaks higher, not lower from here.

Summary: The story and the trade idea was good/OK. There was a reason(s) to see lower levels - failed break and non trending transitioning into trending.

However, the trade location right on support was not a great idea (bad idea!), nor was the risk (too much). Waiting for a break would have been a better idea and getting out earlier would have saved some pips and account balance.

We will all lose when we trade. I am sure HSBC has had better trade ideas, but be sure to be careful about where you are trading, and your risk and you will save yourself some pips on those trades that don't go your way.