How to use CFTC Commitments of Traders data

Each Friday at around 2:30 PM ET, the CFTC releases the weekly Commitment of Traders report. What is it? Why might it be important?

The Commitment of Traders report is produced by the Chicago Futures Trading Commission. In it, it shows specifically, the net speculative positions in a number of futures instruments.

Why speculativeand how do they know?

When an order is placed on the floor of a futures exchange, the buyer or seller matches each other off. For every buyer, there is a seller. The exchange just clears the transactions. That is, they make sure Trader A who bought, has enough margin in his account to buy, and Trader B who sold, has enough margin in his account to sell. The exchange will allow Trader A to sell to another trader, Trader C when that trader wants to get out. Trader B has the same flexibility too. That is they can get out through a trade with Trader D (or E or M or Z, etc).

Now transactions in the futures pit are further bucketed into two main categories.

- Hedging

- Speculating

If the Trader A is hedging an exposure in a currency, he instructs his broker the trade is a hedge. That allows hedge accounting. Basically, the gain or loss on the transaction can be accrued over the life of the hedge for accounting purposes. It can get complicated and I am not an accountant but that is the general gist of it.

Conversely, if Trader A is speculating for profit (or loss), he instructs his broker the trade is for speculation. If so, the gain or loss is realized when the transaction is closed. There is no accruing the P/L over the life of the hedge. You have a short or long term capital gain or capital loss instead.

Now hedgers and speculators have different fear factors and also objectives.

A hedger might be a corporation in the US who has to hedge a payment he will need to make in June to a UK producer of a good he is purchasing. The treasurer thinks the cost of the GBP will go up before June, so he buys protection for that expectation. He is happy with the price he pays today for that protection in the future. His company is hopefully profitable at the price he pays today for his hedge.

Does it mean the hedge will be profitable?

No. The GBPUSD could go lower between now and the expiration of the contract, and his hedge could lose money. However, when the US treasurer makes his payment for goods in the future, he will be buying GBP at a cheaper price. So the gain on the lower price in the currency, will be offset by the loss in his future account. That loss is what gets accrued over a time period using hedge accounting.

Is that treasurer worried?

He (or she) may want to see the hedge be profitable. If it is, he can go to his boss and say, "Look, I saved the company this much from our currency exposure by doing this hedge. Give me a bonus equal to it (haha)" But in reality, the treasurer should be ambivalent. After all, his company is not in the currency speculation business. What he should be happy about is he hedged the currency risk - the exposure. He locked in the rate, and at that rate, the business was profitable. So he should not be worried about what currency rates do.

What about a speculator?

Speculators for profit trade because they want to make... profits. IF they don't buy low and sell higher, they have less money in their marked-to-market account each day. So they can be more influenced by swings in the price. The price can go for them (in their favor) or against them (not in their favor). Therefore, speculators have more fear in their trading because trading IS their business. They are successful, or not successful depending on how they trade. That is their bottom line.

So what does the Commitment of Traders report show?

The Commitment of Traders report takes a snapshot from the close of business on Tuesday of all the positions from Trader A, B, C, D...Z,.etc. and determines which ones are hedges and which ones are earmarked as speculative positions. It then sums up the total hedges and total speculative positions, to get a summation for each. The report will show the net speculative position of ALL the positions.

Tell me more...Tell me more....

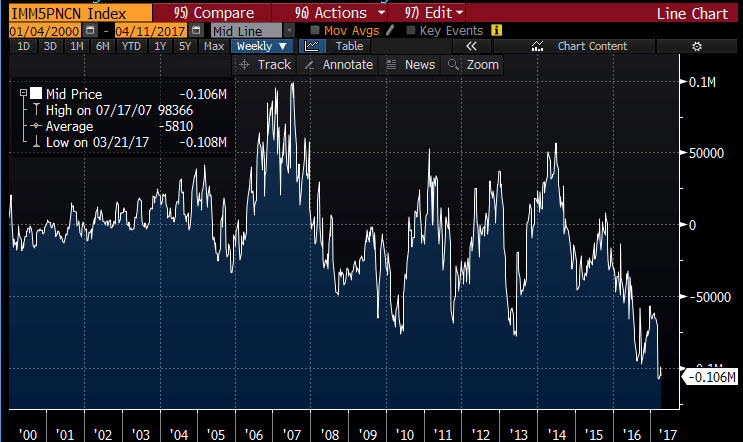

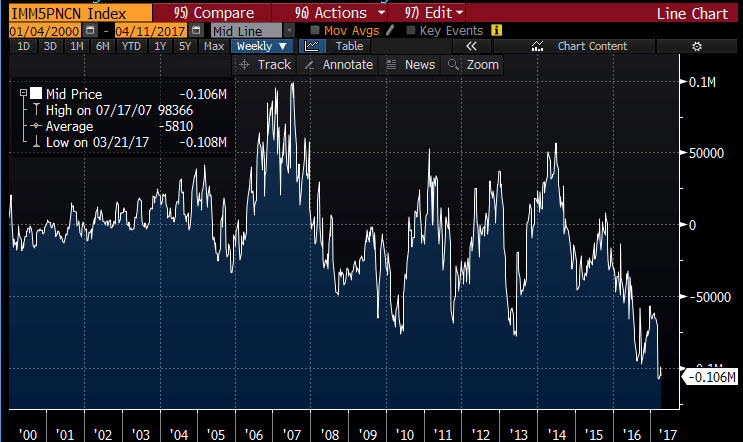

So say there are 106K net short speculative positions in the GBP (it really means GBPUSD). What does that mean? Simply, it means that if you added up all the customers net speculative positions it would show a short of 106K.

If for every sell there is a buy, where are the buys?

The 106K longs/buys are on the hedging side. In other words, the net speculative shorts should = net hedged long positions. Since there are 106K speculative shorts, there should be 106k hedged buys.

What is a characteristic of hedgers?

They don't really care about the P/L on their position. They are hedging risk for their business.

What is a characteristic of speculators?

They REALLY care about the P/L on their position because trading is their business. If they don't make money, they are out of business.

Tell me even more....

Rather than tell you let me ask you a question first.

"If the market is short a record amount of GBPUSD, what would be the worst case scenario for those shorts?'

The answer is of course, the price of the GBPUSD moved sharply higher. This is their business after all.

If the speculators wanted to get out of their short positions because the price is going sharply higher, and there is a record amount of shorts already, what may happen?

There could be a rush to buy at the same time. Who sells to them?

- Other speculators. But remember a lot of traders are already short and losing. OR,

- Hedgers

What might attract more hedgers? Well, some business transaction whereby someone or corporation needs to buy dollars cheap (as the GBP gets expensive, the dollar gets cheaper). Other speculators might come in too, or traders who are already short, may look to "double up (or triple up) to catch up". That is they go "all in", and push all their chips in with a pair of 6s.

What if there are limited sellers? i.e no hedgers and/or the speculators are all shorted up already.

The price squeezes higher and higher.... until the price gets to a point where the sellers finally are able overwhelm the buyers (i.e. more hedgers or more speculators come in).

What about the Commitment of Traders Report today?

Last week's Commitment of Traders Report showed that net shorts in the GBP (i.e. GBPUSD) was short 106K contracts. That net speculative position is near record short levels (the largest position was 108K).

Since the report shows the net position at the end of Tuesday (it is a snap shot of the positions after the close), that report would have been the net short position as of March 11th. ON March 11th the price closed at 1.2490.

This Tuesday (March 18th) was the day the price shot up on the UK snap election announcement. The price of the GBPUSD closed on Tuesday at 1.2838. That is a difference of 348 pips from the March 11th close. For record number of speculative positions, those pips are losses that hurt (PS hedgers are looking good).

Today's report will give us an indication of what did the net speculators do since March 11th.

- Did they get out, and cover in the run up (i.e the net position cut)?, or

- Are they still in it and hoping for a turn around (i.e. little or no change in the position)?

How can it help our trading?

What we will know from today's report is "Is there a chance for more of a squeeze?".

That would happen if the shorts remain large.

IF, on the other hand, the shorts are cut dramatically, we know the move higher on Tuesday was likely fueled by shorts covering. It will also mean the market is more balanced. As a result, we could go either way more easily from this point. That is important to know. It sets a different trading mindset.

Does a large short mean we will continue higher in the GBPUSD?

It depends. However, if there is something bullish fundamentally for the GBPUSD next week, there is a better chance, the shorts get squeezed and the price can scoot even higher, quickly. Pain and fear can drive traders to panic. Note, it is the probabilities that increase for the short squeeze potential that is most important.

What if there is something bearish fundamentally with a large short position?

The price can go down, and the traders who are feeling the pain this week, will get some pain relief. However, they may also be more inclined to buy a dip as well. A "get out of jail free card", often makes dips easier to buy when at one point you were looking over the edge and wondering if you should jump. So be on the lookout for patient buying opportunities perhaps. Shorts may be looking to lighten up given the chance to do so.

Summary

The Commitment of Traders report is a snap shot of risk and fear. When the position is large and going traders way, all are happy. Hedgers don't really care they are losing money. Speculators are all making money.

Conversely, when speculative positions are large and the price is NOT going the traders way, fear increases and there is a chance for quick squeezes in the direction opposite the position.

As speculative traders, knowing how the market is positioned could help in your trade strategy and mindset. If there is a chance for a squeeze because shorts are the wrong way in a rising market, and fundamentals are going against them, squeeze the shorts. GO long...buy.

Alternatively, you can also look to buy a patient dip, in anticipation of the shorts paring back positions on retracements. In other words lean against support levels.

Like a card counter at black jack, "counting the cards" in trading (i.e. knowing the positions) is a way to put the odds in your favor. It should help you in the long run, and also give you a clearer mindset on how to trade the market as well.