by Justin Paolini

Many aspiring traders focus on setups and entries. I would say 90% of their time is actually dedicated to perfecting entries. That is one way to miss the forest for the trees. Back in the 1990's, Tom Basso and Van Tharp had already issued a study on the relative unimportance of entries for producing good trading results. In particular, their "Coin Flip" study showed that across 10 futures markets, a simple random entry with a trailing stop made money.

Assuming they did not cherry pick the situations for the test, is the relative unimportance of entries still valid now? The question for us today then becomes: does the random entry still work or have the markets changed?We decided to answer that question with a research project using current Forex data.A second question we decided to examine was - is the Coin Flip actually profitable over any length of time?

Tom Basso's Coin Flip Study

In his book Trade Your Way to Financial Freedom, Van Tharp explained how he and Tom Basso came up their idea to test about random entries:

"I was doing a seminar with Tom in 1991. Tom was explaining that the most important part of his system was his exits and his position-sizing algorithms. As a result, one member of the audience remarked, "From what you are saying it sounds like you could make money consistently with a random entry as long as you have good exits and size your positions intelligently". - Van Tharp,Trade Your Way to Financial Freedom

Here are the very simple rules Tom Basso used, in order to test the viability of a random entry system:

1) Hypothetical 1 Million dollar account à this is required in order to simulate diversification amongst futures contracts, withstanding margin requirements and drawdowns.

2) Select markets that have more of a tendency to trend, so commodities and futures markets. In particular, the markets backtested on were Gold, Silver, US Bonds, Eurodollars, Crude Oil, Soybeans, Sugar, Deutsche Mark, the Pound and Live Cattle.

3) The Exit is 3*10 Day Average True Range (more on this here) subtracted from the close. The trailing stop can only get closer to the current market price, not further away.

4) Position size: 1% of equity

5) Selected markets must be liquid (so that trades can be entered and exited immediately with low slippage).

5) Always in the market (so as soon as 1 trade is closed, another is opened).

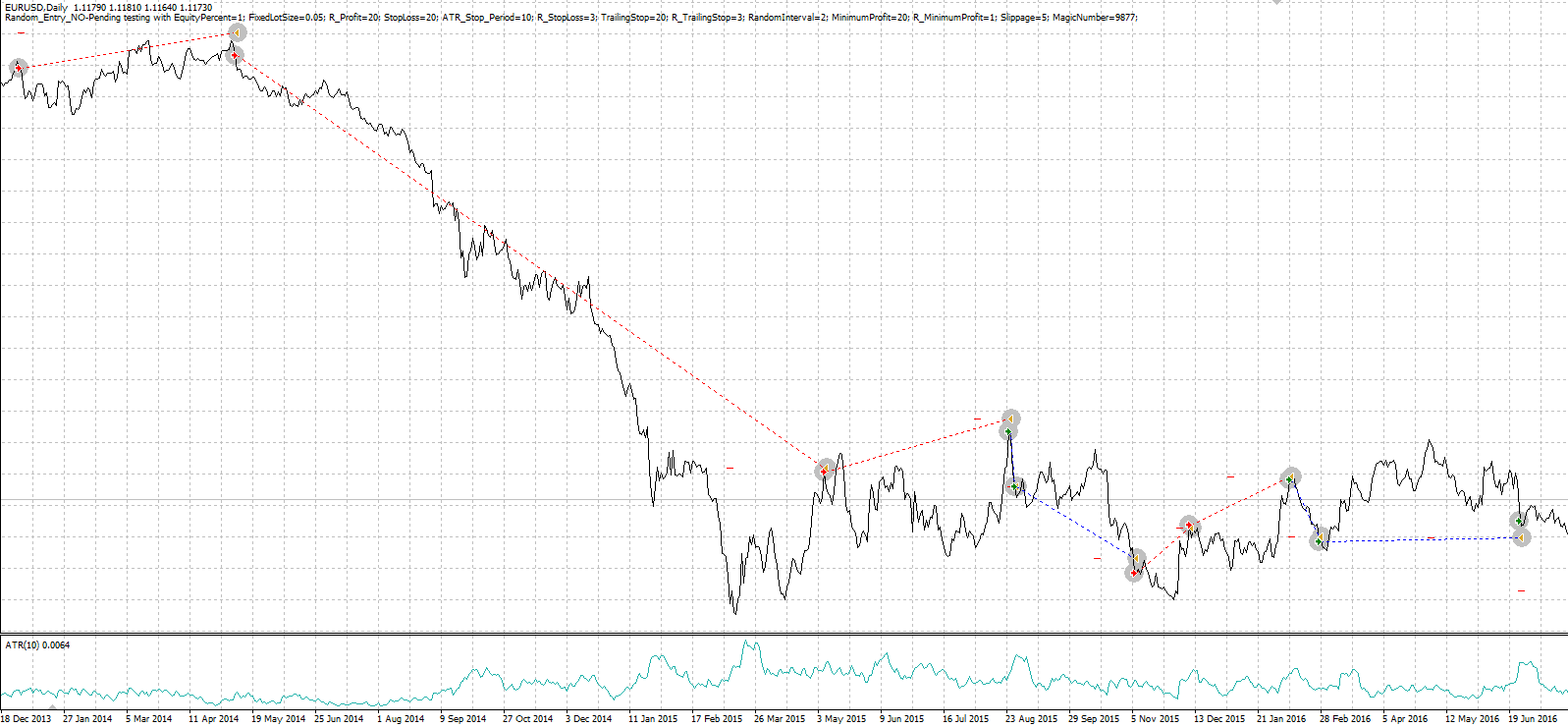

Entry Trades taken as per Basso's Rules coded by Craig Consulting on MT4

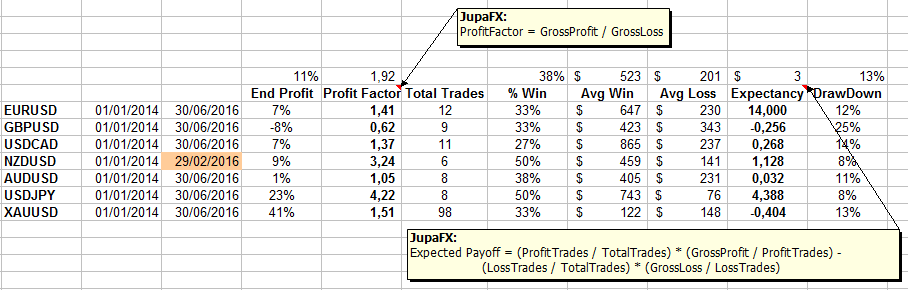

We used these same rules to run simulations in MT4 with the help of our resident programmer Craig. We tested the six FX Major pairs along with Gold from January 1st 2014 to June 30th 2016 (except for NZDUSD which because of data errors, was run only until the end of February 2016). Effectively, we tested the random entries in trending and rangebound environments. Unfortunately, MT4 doesn't have a Monte Carlo generator so we had to do all the runs manually and it was a lengthy process. So we did 20 runs, but we did not find significant deviations from the core concept: Tom Basso's Coin Flip system rules remains as sturdy today as it did back in the 1980s/1990s.

An example of the output in Excel - Tom Basso's Random Entry is in fact profitable in most cases.

As you can see, the random entry method ends up with a profit in most cases (and this was a robust finding across all runs). The profit factor is also interesting, however, there were very few trades and the system produced a very low win rate. Van talks about the psychological part of trading and even with robust statistics at your disposal, you can see how traders would still find it very hard to stomach this kind of a system in reality.

It was at this point that complications and additional questions arose. We asked ourselves: just how random was Basso's system?

To keep the discussion short & sweet, here are our thoughts:

- Real random entries should be random in direction, time and price. So being in the market at all times is not really random. Basso's "randomness" simply asked the algorithm to be "long or short" randomly at a given starting date and then randomly picked long or short after each trade closed. So this means the starting point and initial conditions were likely very influential in the results.

- The markets weren't randomly selected.Forex and commodities exhibit autocorrelation (trendiness) just like the futures contracts used in the original study. This is another bias to Basso's test as stocks do not exhibit the same degree of autocorrelation in returns.

- The exits weren't random at all, are they? The rules for exiting were very clearly defined as to not be random at all.Basso was not testing a purely random system - and neither did we. So we're not saying that it is possible to obtain decent results simply flipping a coin in the market as to when to get in and when to get out.

In fairness, Basso was not testing for profitability of a completely random system.Instead, he simply devised a test to see if exits were much more important than entries.That test was positive but even Van said traders can do a lot better than using a random entry - and still not spend all their effort on the entry.Our initial research results got us wondering about the possibility of putting additional randomness into the test and seeing what came out.What we found was both confirming on some fronts and surprising on others.

One of the confirming conclusions that will emerge in next week's part 2 article of this series is that the exit strategy influences returns more than the average trader expects. In particular, we used a trailing stop which is particularly suited to trending markets. When random entries were paired with trailing stops in range-bound environments, positions get "chopped up" but they really "buck the trend" in a trending environment.The importance of the trending environment (or market type as Van labels it) turned out to be one of the more surprising results from the tests.

Join us next week for the research results and the rest of our conclusions.

This article was written by Justin C. Paolini, trader and co-owner at FXRenew

Want to learn more? Get FREE access to the Advanced Forex Course for Smart Traders