As we stroll towards the US retail sales data an interesting article caught my eye yesterday.

CNBC have written about how a wealth gap is changing retail sales creating a gulf between those shopping at the cheap end of the market to those shopping at the expensive end.

Given the weakness in consumer spending at the moment some of their arguments raise good points. It’s suggested that due to a widening wealth gap, the middle ground has been lost in consumer spending. People who are coming through the crisis with money are still shopping at the high end while the rest, including the normal ‘middle class’ are predominantly shopping at the low end.

It’s fair to say that in most cases everyone has been hit in the pocket in some form by the crisis and from what I’ve seen on the streets there is definitely more emphasis on people all along the wealth spectrum trying to grab a bargain than pay full whack for something. Importantly it’s the middle ground that usually stabilises any shocks in spending and is most important for seeing the real trend. The rich will always buy expensive and the poor will always buy cheap, but the middlers will shift either way on the scale as finances dictate, thus swinging the trend in spending. In this case CNBC make the point that the middle spenders have maybe shifted well into the cheap zone. This would still make volume sales high but low in $ value at the tills.

The knock on effects of this are also far reaching. Well known ‘middle road’ department stores see sales dropping which leads them to struggle to cover costs while producers see that price matters more than quality and so look for cheaper materials. Along the line it leads to a background of falling values and prices and that’s something we are already seeing in inflation figures.

At the best of times retail sale are volatile. While people feel pain in their wallets they are also quick to spend a pound when they get one purely for the benefit of being able to do so.

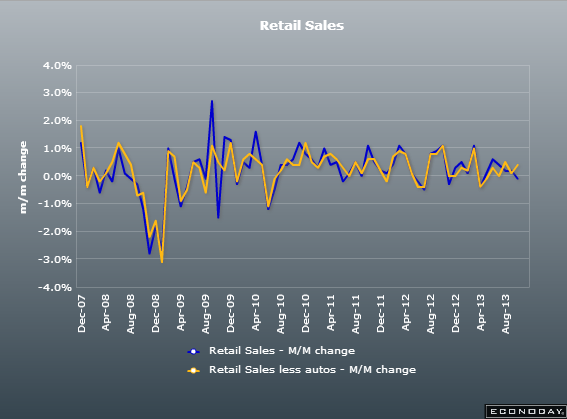

US sales have been on the decline this year but with autos stripped out the picture doesn’t look too bad but overall it’s still a very weak picture.

US retail sales September 2013

Full story from CNBC here.

Retail sales at 13.30 gmt are expected to post as 0.1% vs -0.1% in September m/m, with sales ex-autos and gas 0.2% from 0.4% prior.

The data will give you some volatility on the release but I’m going to be paying more attention to the CPI numbers released at the same time. We’ve previously seen price data pointing to the low side, most notably with yesterdays employment cost numbers, and Q3 productivity costs. The more widely watched PCE prices held steady at 1.2% y/y for the core but fell to 0.9% from 1.2% in the headline number.

Much like in Europe I’m starting to think that we may see a similar episode with the US heading towards lower inflation. My Spidey sense is tingling that, much like the European situation, the market is not yet taking this into consideration. It’s not an issue yet but one we need to keep an eye on. The core CPI is expected in at 1.7% from 1.7% prior y/y with the main number forecast at 1.0% from 1.2% prior y/y. Any big falls in these numbers could see some jitters enter the market.