Lots to digest starting at 2:00 PM ET

The Fed has painted themselves in the corner but the starting gun for liftoff will be shot.

What the traders will be wrestling with AFTER the initial headlines, will be how does the Fed frames it's intentions for the future.

There is an expectation that this tightening/liftoff will be the most dovish on record. How will they do that?

There will be 4 ways to show a dovishness tomorrow:

- The Statement. The last statement was more of a setup for the tightening. What will be said after a tightening is announced?

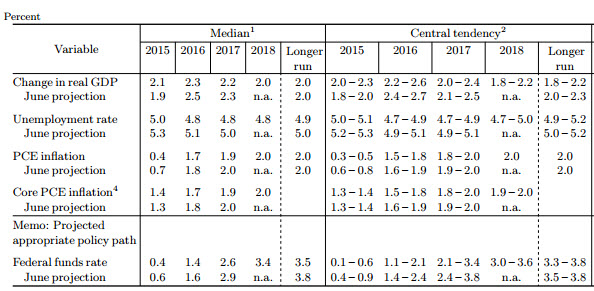

- The Central Tendencies - The Central tendencies were last released at the September meeting. The Fed can show a dovish slant by lowering the expectations. They tend to overstate these numbers but honestly 2.3% GDP sound pretty low already. PCE inflation may have scope for a lower target.

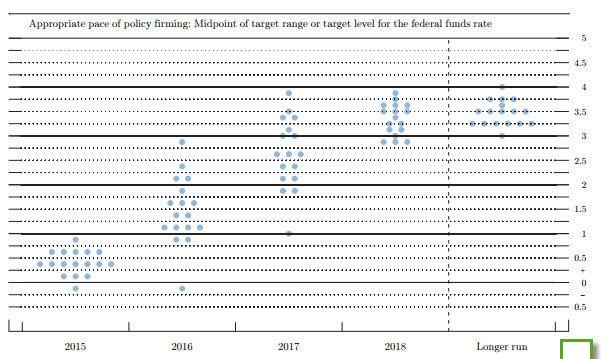

3. The "dot" graph of the rate expectations. This is another thing that Fed officials consistently overstate. For this meeting, does the Fed encourage the votes to come lower, and more concentrated? In the last report from September, the data ranged from 0.75-1.0% to 2.75-3% (I will ignore the Kocherlakota's less than 0% forecast - he has since left the Fed). The average for 2016 was 1.375%. If the range is still wide and still has numbers approaching 3% (even 2.5%), that will not be so dovish. They can show their dovishness in this scatter graph by coming together and lowering their projection to a more realistic concensus.

4. What Yellen says in her presser.

Those are the things that the Fed can influence tomorrow if they want to be more dovish, neutral or bearish.

The Feds buzz phrases before this meeting may also need some explaining now that a tightening is completed.

For example is the Fed still data dependent? Does "data dependent" have a different meaning now that they have tightened once? For example, what happens, if the NFP rises by >230K in January? Is the January meeting live?

What about the transitory inflation. If they tightened with the understanding that transitory inflation one day would not being transitory, what happens if the oil prices correct up to $42-$45 a barrel? Are transitory effects over?

Are there any global concerns?

What about getting behind the curve? We have heard those words from Fed officials in the past. Is the Fed still at the risk of falling behind the curve if oil moves up, if employment is still rising at good pace? If oil goes to $42 and NFP increases by solid amount or the unemployment rate falls to 4.9%, does the Fed risk getting behind the curve still?

There are a lot of questions which to me, will need to be answered if not tomorrow, going forward.

Meanwhile tomorrow smells like it might be a day that may see the dollar move all around as the market digests what the Fed is NOW thinking - and saying as well.