Where do you feel comfortable?

Ryan had a great post earlier today where he talked of volatile markets. In it he said:

"It all feels like there's nothing for markets to really get their teeth into and that can lead to dangerous trading conditions"

He ended it by saying:

"For now just stick to your levels and try not to chase anything too far, if at all. The way markets are trading now you have plenty of opportunity to let the trades come to you. Push to hard and you could end up in a hole."

Shortly thereafter, I posted the following:

"I get the feeling that the flows will dominate (i.e. orders at 1.0900) with liquidity also causing the pair to hop around. So be aware. An option is to sit out and watch for a while. When markets are overly sensitive to things like commodities and they are whipping around, you can find yourself in trouble. You sometimes have to ask yourself, "Am I a Copper/S&P/Oil trader or currency trader?" If you are more a currency trader and those instruments are wagging the dog, it might make sense to sit things out and let the bar room fight go on without you."

Similar sentiments, huh?. We as traders, feel the markets vibes. We make judgments on what might be driving a market and sometimes that vibe...that judgement, does not give a warm and fuzzy felling. We can't "really get" our teeth into it (and don't trust it).

The same is true for my charts.

There are times when I look at a chart and I see perfection. The price is reacting to technical levels nicely. Risk is being defined and limited. Sweet time to trade. I have little fear. I have confidence. It does not mean the market will agree and the trade will be profitable, but I am not hindered by fear.

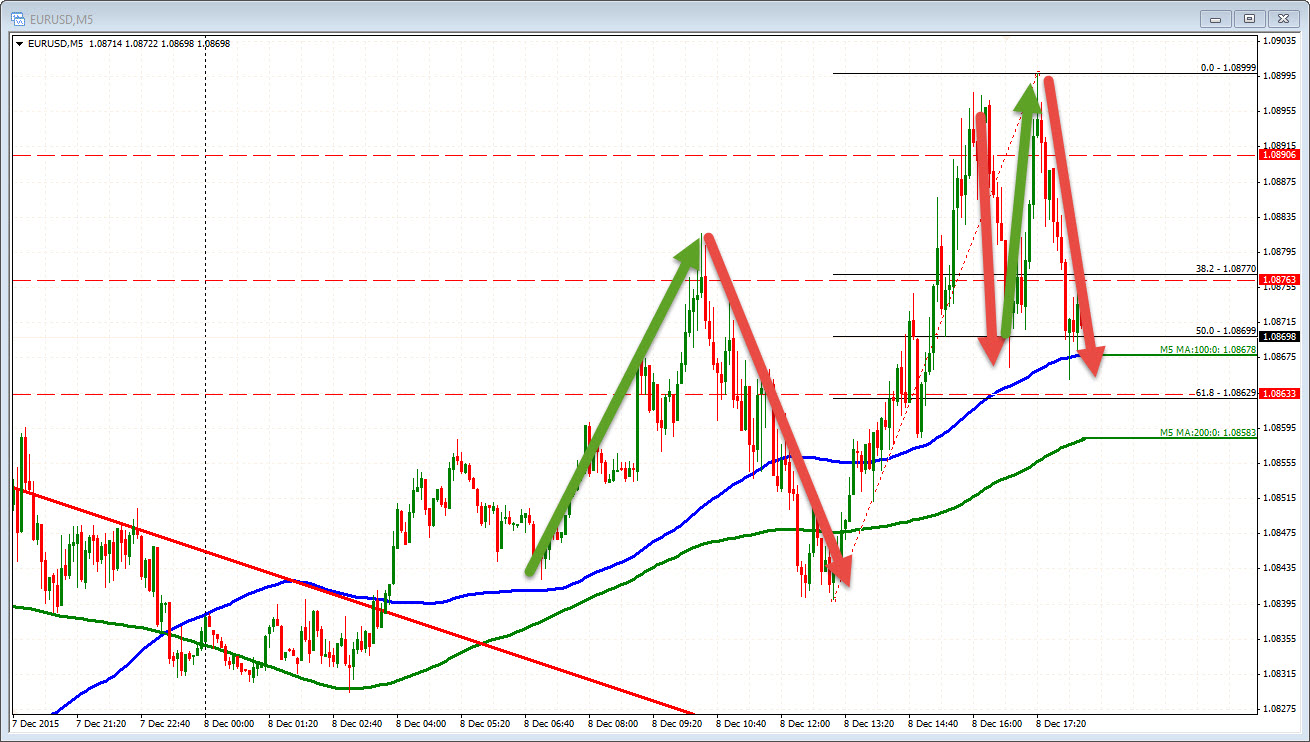

There are other times when I look at a chart and don't like what I see at all. This is one of those charts. The price has had some sharp rallies and sharp falls shortly after. Garbage.

What this all means is that I/we tend to approach markets from a risk standpoint.

Why? One reason is if risk is too high, we tend not to do well - even when we are right.

Have you ever done a trade at a nice level but it is a really volatile, herky-jerky market. You enter and the market goes your way. When I say goes "your way", it might go up 10 pips, come down 7 pips, go up 7 and come down 5. Because the market is volatile, your fear is elevated and you close it without the trade dipping below your entry area. Later when it rallies you curse yourself out for getting out too soon.

I did one of those trades this morning. I bought the EURUSD at 1.0874 and sold at 1.0883 after some up and down gyrations. Yes I made 9 pips but could have made 20 - 25 without much pain at all. But the pain was my fear. What would the stock market do? Is oil going to still tumble? What about commodities? All those thoughts were racing through my mind.

Although I could have made 20-25 pips without once having the price going much below my entry, I also could have watched that gain erode all the way back down too and gotten out with a loss.

The point is, we as traders need to evaluate the market from a risk standpoint then make a trading judgment that makes sense for that type of market. Sometimes that risk is defined by technical levels. Sometimes the risk is defined and influenced by more external factors like oil, or stocks or commodities. If the trading becomes more complicated and outside your comfort zone, fear will increase. Even on winning trades that go your way from the start you feel the pain from the fear.

Can you do anything to make you feel better?

As Ryan pointed out, let the "trade come to you"

So if selling the EURUSD at 1.0900 is an extreme that you feel comfortable selling at, wait for that extreme (Ricardo's comfort trade from an earlier post). If it does not get there, don't trade. To be even more cautious, maybe wait for a "break and failure" before jumping in (as suggested by Chase from the same earlier post).

Then define your risk. NO need to risk a lot (10 pips at the most) after all you think the level is an extreme that you patiently waited for. If you feel uneasy still, try lowering the amount of the trade. Once in, don't look at oil. Don't look at commodities or stocks. Just trust what you see on your currency chart (you cannot predict the next 50 cent move in oil or next 5 points in the S&P anyway). Your goal is not to have fear. Watching all those things increase your fear.

If the trade goes your way, take a little off the table (25%-40%) to release even more pressure from the market volatility. If you can move your stop down as the trade goes your way, do so. As far as taking full profit, don't be so greedy on these days. Remember, you may have controlled your fear, but there are plenty of other traders who will be reacting to each little movement in ancillary markets. If you want, pick away at the position but keep 25-33% to run - just in case the market does lose some of "the attitude" it had, and starts to trend and trade normally.

The goal on these days is to first understand what type of market it is and then control your risk and fear. And remember as well, if you don't want to get in the bar room fight that is always an option worth considering. There will always be another trade.