BOJ and Fed are the big central bank events this week

Whatever your view is on the BOJ and the Fed and their paths for QE or rates, there's always an opportunity for a trade

Trading the 'actuals' and the 'expectations' can be worlds apart but they can also both combine to lead to good opportunities.

Most people expect the BOJ to do nothing at their meeting, which is due to conclude tomorrow. On paper it should be neutral for USDJPY but don't rule out the pair suffering a loss when the announcement is made.

For the Fed, there's a good chance we see some bullish action as the bulls set themselves up for a hike or at least a hawkish outcome

And therein lies the trade, trading the actuals of the BOJ and then the expectations of the Fed. A decent drop in USDJPY on the BOJ could be a decent buy to hold up to or over the Fed, depending on your risk parameters.

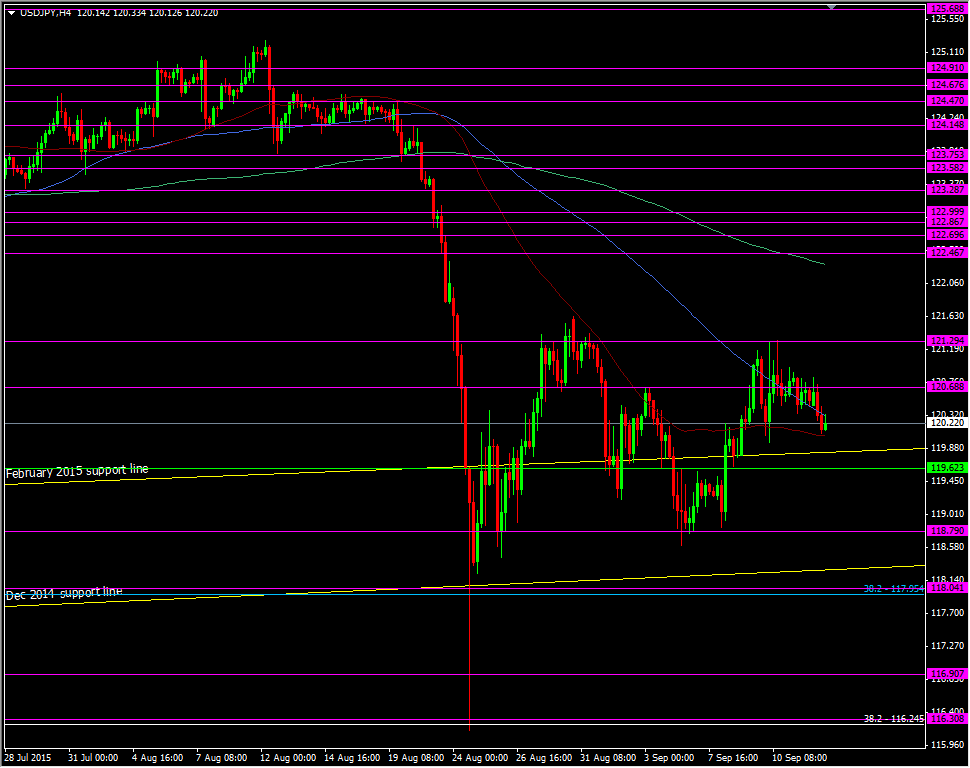

I'm not expecting any major reaction from USDJPY to the BOJ but if we get a drop of around 50+ pips or a move down to any decent tech levels, say down to around the 119.60/70 area then I'm going to think about a long. Certainly down to the low 119's or 118.80 looks good also but it's going to depend on where we are at the time of the announcement

USDJPY H4 chart

I'm mainly looking for a short term opportunity to grab a few pips in the run up to the Fed, and depending on where we are into the FOMC, to either get out or run it over, again depending on where the price is at the time. The reason I'm not so keen on buying at the current level ahead of any Fed expectations is that I want the market to give me some buffer by dropping first and giving me good techs level to lean against