Summer time does not help either

AUTHORS NOTE: This post highlights a frustration we as traders may have with what is going on from key "influencers" like the Fed. The reality folks is that the Fed (and other central banks) are made of people, and people are not perfect. They often times say and do things that seem quite....well quite stupid in hindsight (although they may never admit it publically). We as traders have to learn to deal with that fact. At the end of the post I give some advise on how to cope and trade in frustrating markets when those 'influencers" around you, seem to be making things more difficult.

--------------------------------------------------------------------------------------------------

The debate about the Fed's intention continues - will they start the "lift off" or will they delay once again. As mentioned in my webinar last week (you can see a rebroadcast here) the expectations are all over the place and quite frankly, the Fed can be it's own worst enemy. In their transparency, they have shown that they can do a pretty good job of painting themselves in a corner. They also have a pattern of not really getting things right.

Let's review.

Remember when the Fed stated that they would start raising rates when the unemployment rate hit 6.5%. That idea was shelved because it was 'outdated'. OK.

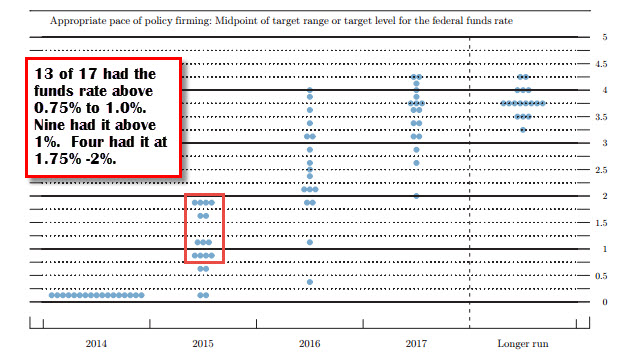

Then there was the dot-graph. The problem with the dot graph is when you think out a year, it is easy to have the courage of 1000 matadors. This is the dot graph at the December 2014 meeting. For the end of 2015, the vast majority had the targeted funds rate above 0.75%-1.00% (13 of 17). We are now hoping for 0.25%-0.5%. Nine of 17 had rates above 1%. Four had the end of 2015 funds rate at 1.75%-2%. Really. That implied raising rates at every meeting. That survey was done in December 2014.

Then there is the economic projections.

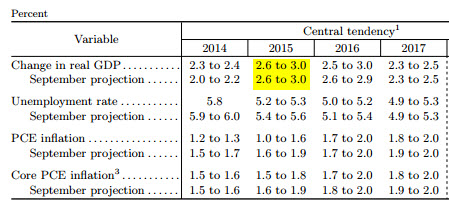

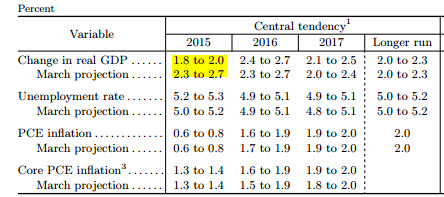

Below is the December 2014 projections for 2015 and beyond. The 2015 GDP forecast was 2.6-3.0%.

In June 2015 (the last forecast), that projection was lowered to 1.8%-2% .Inflation has also been revised lower from 1.0-1.6% for headline to 0.6%-0.8%. Not too good on inflation forecasts.

The fact the Fed has a press conference every other meeting paints themselves in a corner as well. The market believes that the Fed won't tighten in a month that is not a "press conference month". So it is either September or December. Why not have a press conference after each meeting, just like the ECB?

Data dependent? Isn't that somewhat obvious. Why make it your new mantra. At Jackson Hole, Fed's Fischer said that he wanted to see the next data before meeting. Really? Meanwhile, the stock market is on shaky ground and I get a feeling that China can be a bigger deal (it is the 2nd largest economy after all). Yet Fischer (and other Fed officials) want to see data that is not forward looking.

Of course when it comes to inflation, the Fed will be happy to add the "our expectations for inflation" argument. Judging from the expectations for rates from the dot graph and expectations for growth and even inflation from their economic projections, their track record is pretty awful. Yet they see 2%. OK, whatever.

We have not yet discussed the unwinding of the balance sheet and how that might progress, if and when it might be started.

About the only thing the Fed did do properly was the taper process. They started. They continued and ended it.

So all of this, from the worlds largest economy, has created a huge debate, and that has markets confused.

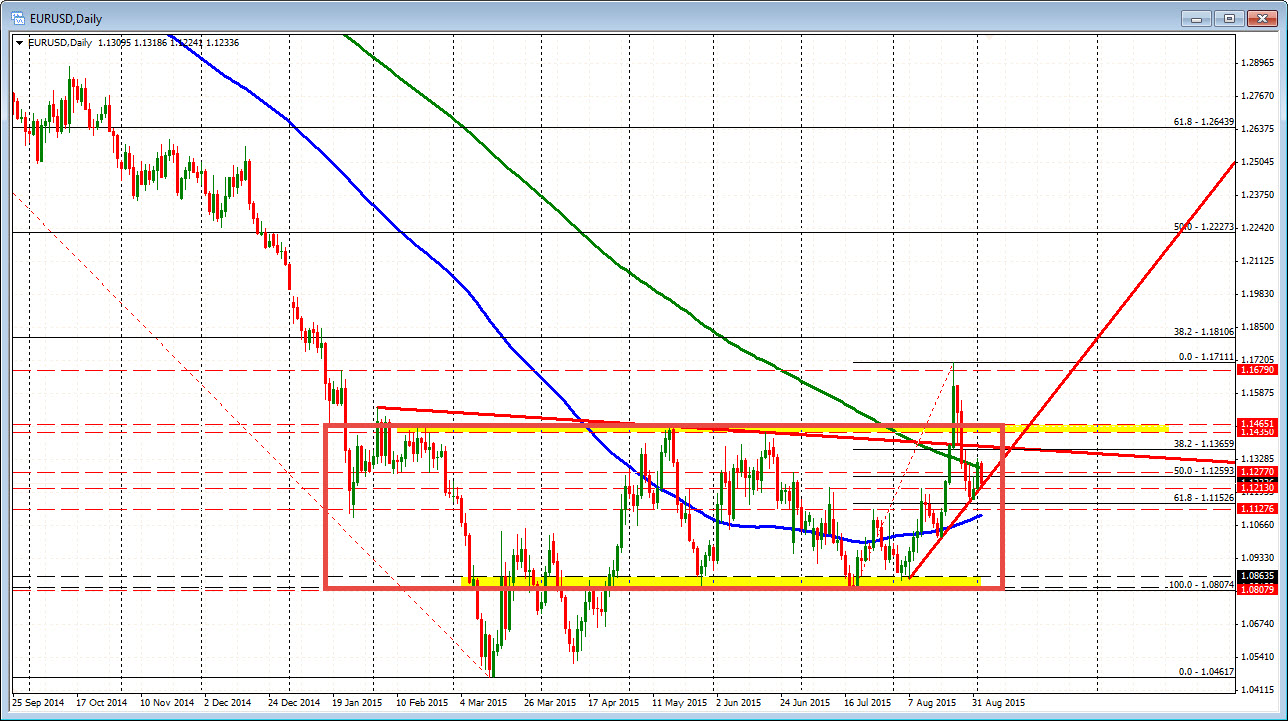

Looking at the EURUSD daily chart, ignoring the spike higher after the stock market collapse on August 24 (one can argue it was a technical move as the price broke above the 200 day MA for the 1st time since June 2014), the pair has been confined to a trading range, with ups and downs.

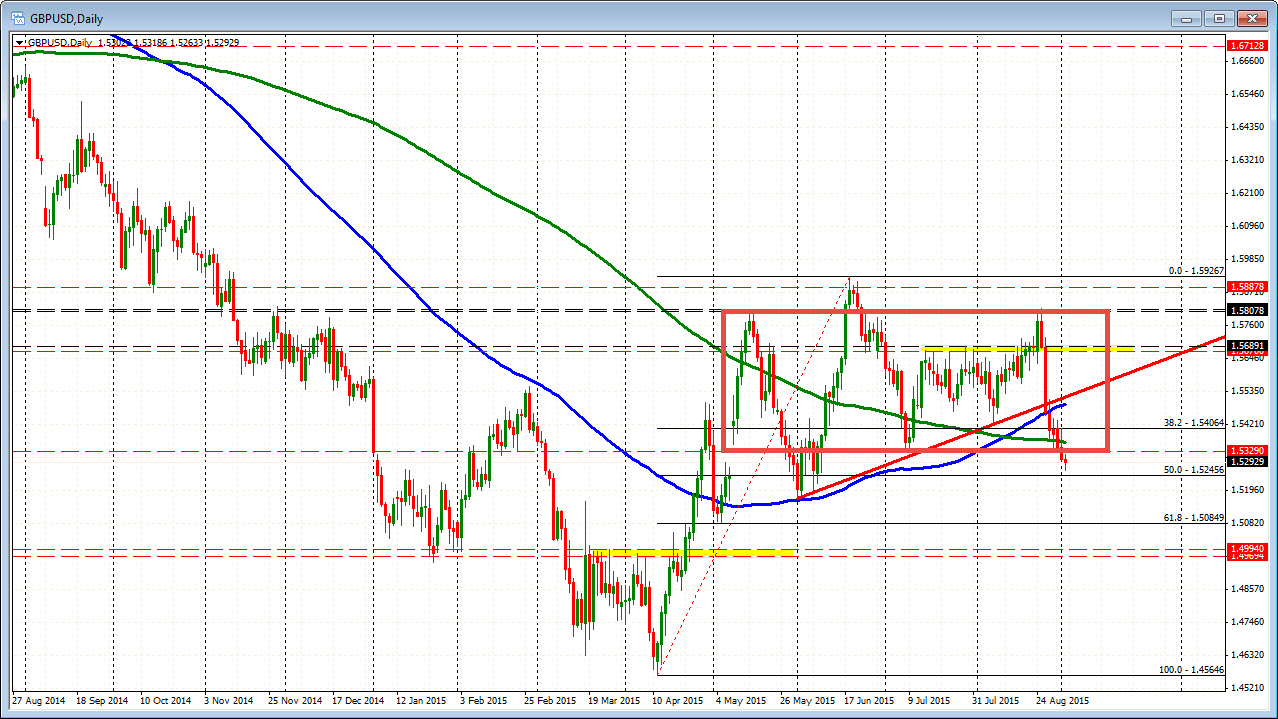

The GBPUSD shows the same with the market price moving higher and lower in range(s)...

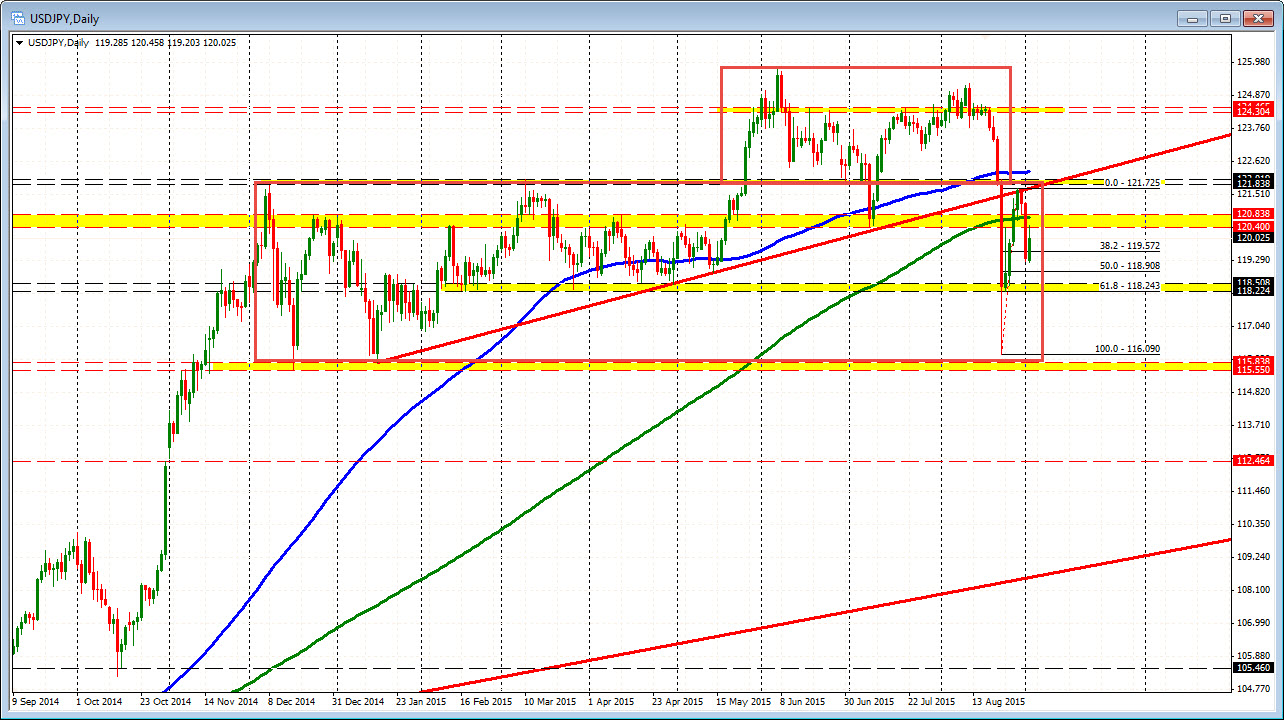

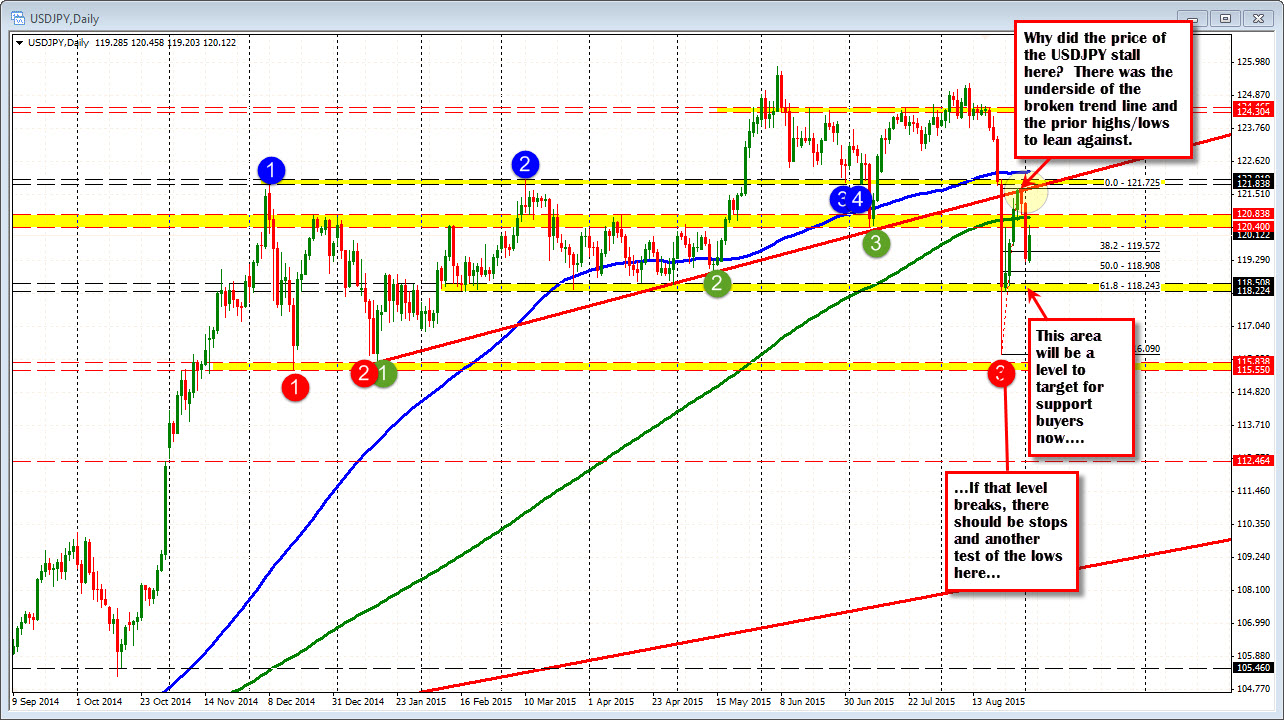

...as does the USDJPY. This pair broke sharply lower after the stock fall, but held a prior low and bounced higher.

What to do as a trader?

Recognize the uncertainty from the what you see in the price charts. Recognize the uncertainty from the fundamentals (we did not even talk about the EU/ECB and the uncertainty there or BOE/BOJ/PBOC, etc). Recognize things like an oil tumble and it's uncertain effect on inflation/growth. How about the stock market? What will that do to confidence? Will it pass like all the others before it or is this something that will last (it is looking more and more like something that might last). You might want to add summertime trading as well. We will see if that passes in September. All those things - especially with the price action - leads to a conclusion that the "market" really does not know what might happen either.

Will that log jam be broken?

There are a lot of balls in the air and the Fed will likely confuse vs help clear the picture. This points to the argument to expect more of the same. This is the default. So look/anticipate what we are seeing and trade that way.

That involves:

Being patient: Wait for your levels. Traders will want to define and limit risk at levels that they can feel comfortable. In the USDJPY bounce back rally, the pair stalled against the underside of the broken trend line and the highs/low (blue circles). Traders stuck the patient toe in the water.

If we HAD moved above that level, there would have likely been stops and the picture may have been different, but the level held and the price fell down. Now the patient buy level will look toward 118.22-50 where there are a number of lows (see chart). Be patient.

You can be patient intraday as well. It does not have to be confined to the daily chart.

Looking at the hourly chart of the EURUSD below, patient traders waited for the trend line support on August 31. Yesterday, they waited for the 200 hour MA. Today the pair is once again testing the trend line. Is this a patient buy level? It is, but it is also dependent on getting back above the 100 hour MA (blue line in the chart below). There is battle but patient buyers can define and limit their risk.

Taking profit. Up and down markets can lead to lots of wins that turn to losses. So manage the trade by having targets. If a target is reached, but stalls, the market can turn around and that gain can become a loss.

In the example below, the GBPUSD found support at the prior day low. Patient buyers there would want to see the topside target trend line broken. When the price stalled at the trend line target, that was a clue. Take profit. It is ok in this market environment. Yes we like to attack the currency trends, but understand that the market trends become shorter in duration sometimes.

I like to remind traders to "fall in like" with the market/position. Don't "fall in love" with it. Powerful, longer term trending markets are where you fall in love. Up and down with small trends brought on by debates and uncertainty, require taking profit.

So pay attention to your targets. By the way, targets also give traders clues if the market is transitioning to becoming more trending. If the price goes above that trend line in the chart below, it now becomes support/risk. Look for the next target at the 100 hour MA (blue line in the chart below). Trades in this type of uncertain market require lots of management from step to step.

Not betting the farm: When uncertainty prevails, it probably is not the time to bet the farm with large positions. Sentiment can swing quickly. Sometimes it is not on a patient technical level. So try to keep positions smaller than usual. If you risk 2%, risk 1%. Lower the position size. Businesses are more cost conscious in a slower economy. In trading when uncertainty is high, be more aware of your risk from a position size standpoint.

What if the default idea (i.e. more up and down) is not the way. That is the market does start to trend (it might just be a summer thing. So one eye is still watching the clues).

If so, you will see that the shorter term trends, start to extend the range. The boxes in the daily chart will be broken. Your targets continue to get broken - one after another.

The good news is the price action will not lie. It is hard to hide traders (i.e., the big ones) who really want to move in a directional bias.

So use your tools that give a bias. Use your targets to show the roadmap and if the market does start to trend, you will start to see it (you should be that way too).

As the debates rage, and uncertainty prevails, the markets become more uncertain. In those markets traders have to adjust to the environment to survive. There will be better markets ahead, but we need to survive the chop first.