Here we are again up at one of the big resistance points in the path of my EURUSD longs. How should I play it this time?

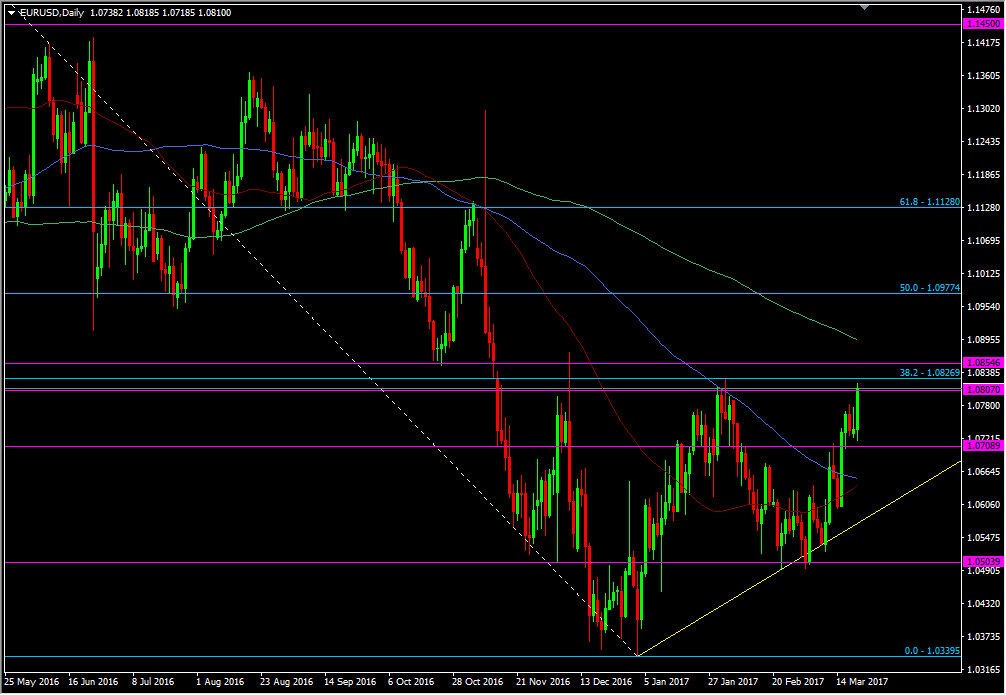

The 1.0800/30 levels have been big levels for the euro since late 2015. At various times we've seen them as major support, and more recently as resistance.

This area was one that I had flagged when I started building my longs and I failed miserably to act the last time we were up here.

Back in Jan I wrote;

"The 1.0800 & 1.0830 are levels I remember very well through 2015/16. They were very strong levels multiple times on the way down, and I need to see whether they are again on the way up, if we get that high. This is going to be where I have a real assessment of my trades on the upside, as a failure to break there could mean a steep pullback. It's at this point I may decide to take partial profit on some of my higher priced positions, with a view to scaling them back in on a failure dip. Trading that way means you can take some profit along the way, and use the subsequent price action to reload and/or increase the position further. I would also look to add to the position on a confirmed break of 1.0800/30, meaning I'm still building on the way up, not on the way down. If we do get above the 1.0800/30 area, I'll have another fuller assessment to see what stands in my way next."

The problem we have as traders (the one I suffered with last time) is the failure to believe that the price won't keep going in your direction. We're into a winner and we want it to carry on to the moon.

There's always a fight between looking at the levels objectively and being sucked into thinking your trade is invincible. I had the objectivity when I was putting the trade on but I failed in my discipline to maintain that objectivity when we got here last time. Instead of following my trading plan, taking some profit, and seeing what happened next, I closed my eyes and believed (more hoped) that it would break and keep on going up, and that's where I failed. I failed when it didn't stay above 1.0800 and I failed at every other support point on the way down.

What that failure does is create even more indecision next time. Here we are again up at those levels but instead of having a clear mind, I've got to weigh up whether I follow my prior plan or wonder whether this time is different, having mucked it up last time.

So let's try and look at the evidence that will convince me what to do next.

Why are we here again?

The biggest question of all. When judging moves you need to know "why?". Why has the price gone up or down? Is there anything different to last time?

Last time we came up here it was a mixture of USD selling following the Dec hike, and the prospect of the ECB tapering QE. We traded the expectation and once we had all the answers we made a top and fell back.

This time the picture is different. Eurozone inflation is higher, Fed hikes aren't causing USD to remain strong, the market is growing increasingly hawkish about the ECB. I didn't believe in the move last time but there's more to believe this time. The reasons I see in front of me now are the reasons why I started buying in the first place. But yet, I don't want to be caught out twice, so my mind is more at odds with itself than last time. I'm facing a greater psychological battle than before.

There's an easy answer to all this and it requires ignoring all the noise and just trading. Right now I can sell a slice of my longs and bank some profit. There's never anything wrong with that. And after, instead of worrying about whether I'm right or wrong, I can trade the trade how I wanted to in the first place, which was buy a subsequent dip back below here, or a break above here. Doing that without a second thought removes the indecision, the mental fight in my mind about "missing out". I can follow the plan and trade the rest after.

So, I'm going to look to take a small chunk off my position now or soon. I'm going to set a stop just below 1.0780 to close part of my higher priced longs I entered into at 1.0656 (my first entry point). That will remove some of the closer risk and allow me extra room from the lower price trades. If I use a stop, I can forget about it, sit on my hands and let the market do the trade. If I leave it to my own discretion, I might talk myself out of it again. If we do move higher but I see that I'm facing a big resistance fight, I'll move the stop up. That way I can lock in those extra pips without the added risk of being blown by a pullback.

If we fail to hold up here then I've banked some and I can look to reload. If we get above 1.0830, and probably 1.0850, I'll have greater confidence in this break and will look to add that position back on.

EURUSD daily chart

Where is my risk now?

I can't concentrate on what might go right and completely ignore what can still go wrong.

The 1.0500 level was my big worry level. Above I'm happy, below I'm nervous. That hold back Feb was a very strong technical signal. Traders said "we are not going below here". That showed big protection of the 1.0340 lows and that's exactly what you want to see if a price is going to protect a bottom. I would expect to see 1.0500 protected now, the same as 1.0340 was, and to try and plan for that I'll use the trendline from the year's low through the Feb bottom. Right now that stands at 1.0570 odd, and is ever increasing. That's my new 1.0500 nerve level. In the shorter-term picture, 1.0700/10/20 is where I'd want to see any failure here pulling to keep the bullish momentum intact. Every good rally needs a refresher now and again. If that breaks then I'll look at the trend line to add to my position again.

That's my plan but I want your advice on whether it's a sound one or not? Let me know how you deal with these psychological battles we all face.