We play with fire...

When we trade, we accept that there may be times when we get burnt. Let's face it, there is a bunch of stuff that can cause the story to change, and then change again seconds later. We are playing with fire.

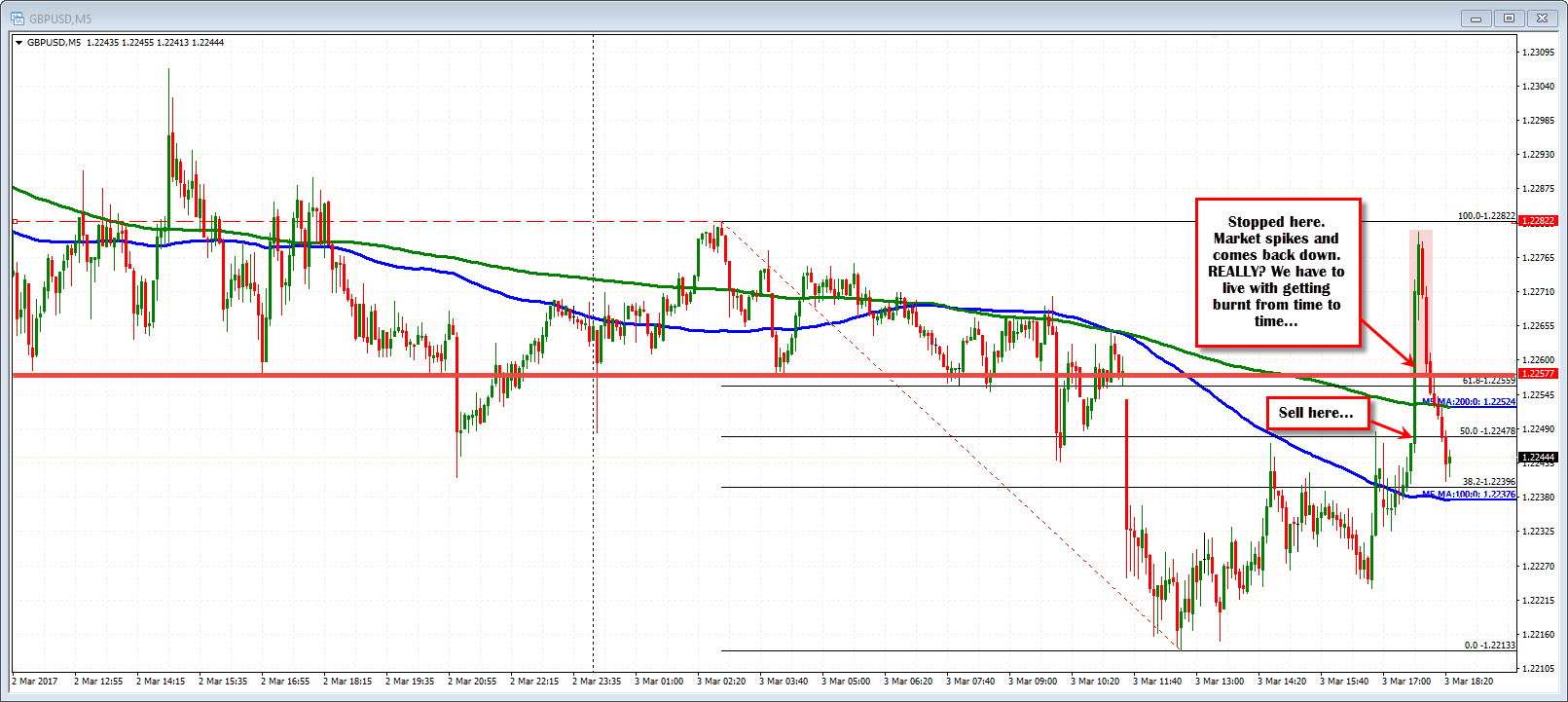

The GBPUSD just had one of those playing with fire moments.

There was reasons to define risk against the 1.2255-59 area. I outlined the story in a post here. Sell against that area. Stay below is more bearish. Move above is more bullish.

Well, the fire was lit on a break of that area technically, and it may have been helped by Friday squaring, the London fix or some other story. The fire sent the price up to 1.2281. It was not a huge move, but relative to the range for the day and the speed of the move, it surprised.

To make matters worse, shorts who were stopped out, then saw the price move back to where it all started. UGH. Damn algos. Those manipulators. What just happened?

The lesson is that when we do this thing called trading, we have the chance to get burnt.

We can point the finger. Blame the stop hunters. We can say we knew that spike would happen just the way it did.

Although we can feel sorry for ourselves, the fact is we need to accept this type of stuff from time to time, and live with it. It comes with the trading territory.

What we CAN do and be in control, is make sure we understand where our risk is, try to limit it and accept it.

If the price action does what the GBPUSD did and the stop gets triggered at 1.2259, that's too bad, but we have to accept it. There will be times when it breaks and goes up 100 pips. We simply do not know.

We get burnt sometimes. But if you play with fire - and traders do - getting a little burnt comes with the territory. We just want to make sure the burns that do happen are limited.