Forex news for NY trader son December 14, 2017

- US stocks end the session with losses. No records today.

- BoC's Poloz says wants the economy to run hotter for a while

- EURUSD stays below the 100 day MA on retest

- Bundesbanks Weidmann: Loose EU monetary policy contributes to deceptive calm

- Trump. We are getting rid of job-killing regulation

- 4 key themes to drive FX performance in 2018 - Credit Agricole

- BOC's Poloz: Caution isn't a code word for being on hold

- Marco Rubio says he will oppose tax bill until child tax credit fixed - report

- Mexico central bank raises benchmark interest rate to 7.25% from 7.0%

- BOC Poloz: wages remain below the typical average at this stage of cycle

- Dollar moves lower. Tax legislation concerns. Repeal of net neutrality

- BOC's Poloz says Bitcoin is more like gambling than investing

- Republican Senator Lee is undecided on whether to support tax legislation

- Goldman Sachs raises 4Q GDP tracking

- BOC's Poloz: Increasingly confident economy will need less stimulus over time

- Bank of France comes out with own growth and inflation forecasts

- Minority of ECB rate setters wanted to signal guidance may change if inflation keeps accelerating

- Atlanta Fed GDPNow estimate back above 3%. Rises to 3.3% for 4Q growth.

- IMF: Fed's future moves in policy rates should be gradual

- Two senators to watch on the US tax bill

- US October business inventories -0.1% vs -0.1% expected

- US Markit prelim services PMI 52.4 vs 54.7 expected

- EURUSD likes the ECB growth bump up. Inflation seen higher but oil/food. It does not like that...

- Draghi Q&A: We're increasingly confident on inflation path

- ECB forecasts: Sees 2018 growth at 2.3% vs 1.8% prior

- Draghi opening statement: New forecasts signal strong pace of economic growth

- US import price index MoM 0.7% vs 0.7% est. YoY 3.1% vs 3.2% est.

- Canada October new housing price index +0.1% vs +0.2% expected

- US initial jobless claims comes in at 225K vs estimate of 236K estimate

- US November retail sales +0.8% vs +0.3% expected

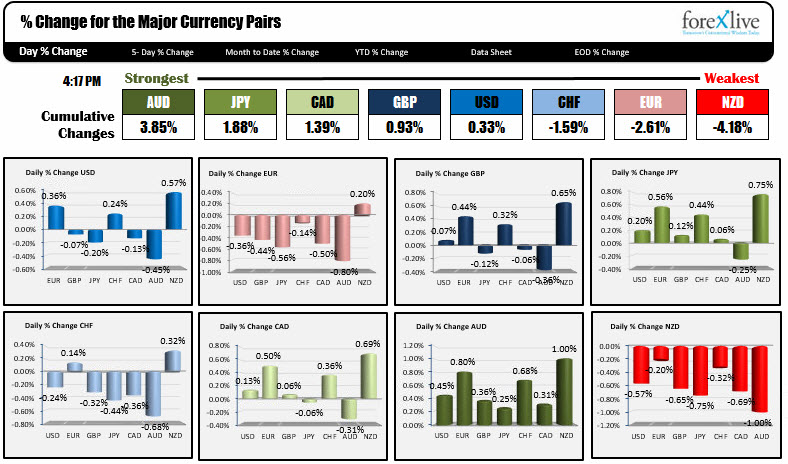

- The AUD is the strongest after better employment. The NZD is the weakest.

- ForexLive European FX news wrap: SNB, BOE, ECB leave rates unchanged in central bank land

In other markets near the NY close:

- Spot gold is trading down $3.01 or -0.24% at $1252.58

- WTI crude oil futures are trading up $.58 or +1.02% and $57.17. Brent crude is up $1.05 or 1.70% at $63.50

- US yield curve continued to flatten. Two-year 1.813%, +3.8 basis points. 10 year 2.351%, +0.8 basis points. 30 year 2.7078%, -1.9 basis points

- US stocks are ending the session lower. S&P index -0.41%. NASDAQ composite index -0.28%. Dow industrial average -0.31%

- bitcoin is trading at $16,375, down $387 more -2.35%

The ECB and BOE both kept rates unchanged today. The ECB Draghi speaking, so there was a lot to digest by the market. Key take away's from the ECB Draghi:

- Rates were unchanged and likely to remain that way for an extended period time

- QE will continue at €30 billion per month until September 2018 (and perhaps longer).

- Inflation projections: 2017 is expected to come in at 1.5%. 2018 was pushed up to 1.4% from 1.2%. 2019 remains unchanged at 1.5% from prior estimate. 2020 inflation is expected to come in at 1.7% which is still below the 2% target for the ECB. Needless to say, if so, the ECB may stay where they are for quite a long period of time

- GDP growth is seen at 2.4% in 2017 versus 2.2% prior. 2018 growth was increased to 2.3% from 1.8% prior. 2019 growth is seen at 1.9% versus 1.7%. 2020 growth is seen at 1.7%. So growth is okay especially in the short term but the ECB is not very positive about the momentum continuing long-term

- They did say that the economy has been improved significantly but wages are reacting way, way slower than in the past

The comments certainly did not scare the market into thinking that the ECB would start to taper further. That coupled with some pretty decent data at a US in the form of retail sales and initial jobless claims, help to weaken the EURUSD. PS the US data led to a rise in the Atlanta Fed GDPNow estimate for fourth-quarter growth to the revised to 3.3% from 2.9% previously.

As far a price action in the EURUSD, the price decline moved back below its 100 day MA at the 1.1800 level and toward a test of the 100 hour MA at 1.17787. A NY afternoon correction on the back of some concerns about the US tax reform passage, took the price back to the 100 day MA (high reached 1.1799), where sellers stalled the move (good stall point). The pair is going out with the price moving below the 100 hour MA at 1.1778. For the new trading day, STAY below the 100 day MA keeps the bears in control (stop for shorts). On the downside remember the 1.1712-24 area.

The USDJPY was not as supportive for the USD today. It was more concerned about how the yield curve continues to flatten in the US and the implications of that. The 2 year yield rose 3.67 basis points, while the 10 year rose by only 0.7 bp. . That puts the spread at 54 basis points. You have to got to November 2007 to get that narrow.

The USDJPY fell through a trend line at 112.55 and then the 50% of the move up from the November 27th low at 112.29, on it's way to a low at 112.08. The pair did rebound into the close and trades at 112.34, but the market will continue to keep an eye on the interest rate market.

The Mexican central bank tightened in the NY afternoon and it did help to strengthen the MXN, but only temporarily. The price fell below the 100 hour MA at 19.0627 on the way to a low of 18.977, but the snap back rally, moved back above the MA line and sellers of the pair gave up. The USDMXN is ending the session at day highs (at 19.15207).

The AUDUSD did all the rallying after the stunning employment report early in the session. The pair got "sort of" close to the key 200 day MA at 0.7691 (the high reached 0.7679), but really did not threaten a break. If a 61.6K job gain is not going to send the AUDUSD back above the 200 day MA, it makes you wonder if you are better off selling? Longs are likely not scared out just yet, but if there is a test of the 200 day MA, and it does not go above, look for the longs to give up and sell.

Below is a snapshot of the strongest and weakest today. The AUD was the strongest, while the NZD and the EUR were the weakest. The USD was all mixed up with gains vs the EUR, CHF and NZD and declines vs.t eh AUD, JPY, CAD and GBP.