Forex news for New York trading on August 18, 2017:

- Trump to Bannon: You're fired

- New York Fed Nowcast Q3 tracking forecast rises to 2.1% from 2.0%

- Fed's Kaplan sees 2017 GDP growth a little above 2%

- A bad bet on a pipeline led to a $100m loss at Goldman Sachs

- U Mich August prelim consumer sentiment 97.6 vs 94.0 expected

- Canada July CPI +1.2% y/y vs +1.2% expected

- CFTC Commitments of Speculators: Big bets against the US dollar trimmed

- Australia to regulate cryptocurrencies

- Baker Hughes US oil rig count 763 vs 768 prior

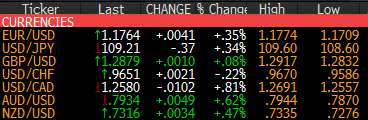

Markets:

- Gold down $1.63 to $1286 after hitting $1301

- S&P 500 down 4 points to 2425

- WTI crude up $1.55 to $48.65

- US 10-year yield up 1 bps to 2.19%

- CAD leads, CHF lags

The US dollar wanted change in the White House and it came Friday as Steve Bannon was sent packing. USD/JPY was at the lows of the day at 108.59 ahead of the news and then climbed as much as 100 pips higher before finishing at 109.17.

One spot the US dollar couldn't get any real momentum was against the euro. EUR/USD traded in a 1.1730 to 1.1765 range in North American hours and closed out the week at the top of that range.

Cable was a disappointment as it failed to hold early gains and skidded as low as 1.2830. It did managed to bounced to 1.2880 late to finish with a slight gain but at a time when the US dollar is struggling, the pound's underperformance is a red flag.

The Canadian dollar got a two-pronged jolt. The first leg came from the CPI report. Although the data was only lightly strong, it was enough to spark a big bid that sent USD/CAD down to 1.2600 from 1.2660. The drop continued down to 1.2573 at the end of the day on the largest one-day jump in crude since November.

AUD/USD was choppy and slumped early in US trade down to 0.7910 but later it found a bid and finished at 0.7934.

One chart worth taking a look at on the weekend is gold. It appeared to be breaking above a major double top at $1300 early in the day but faded after Bannon was fired. Ultimately, it finished slightly lower.

Have a great weekend.