Forex news for trading on July 24th, 2017

- Nasdaq closes at record high. Alphabet earnings after the close.

- Crude oil futures settlement at $46.34/BBL

- Forex technical analysis: Can the NZDUSD stay above it's 200 week MA?

- Fed bans Ex Barclays trader Michael Weston from working in banking industry

- Fitch: Canada growth expected around 2.5% in 2017

- CSNB Jordan: CHF still significantly overvalued

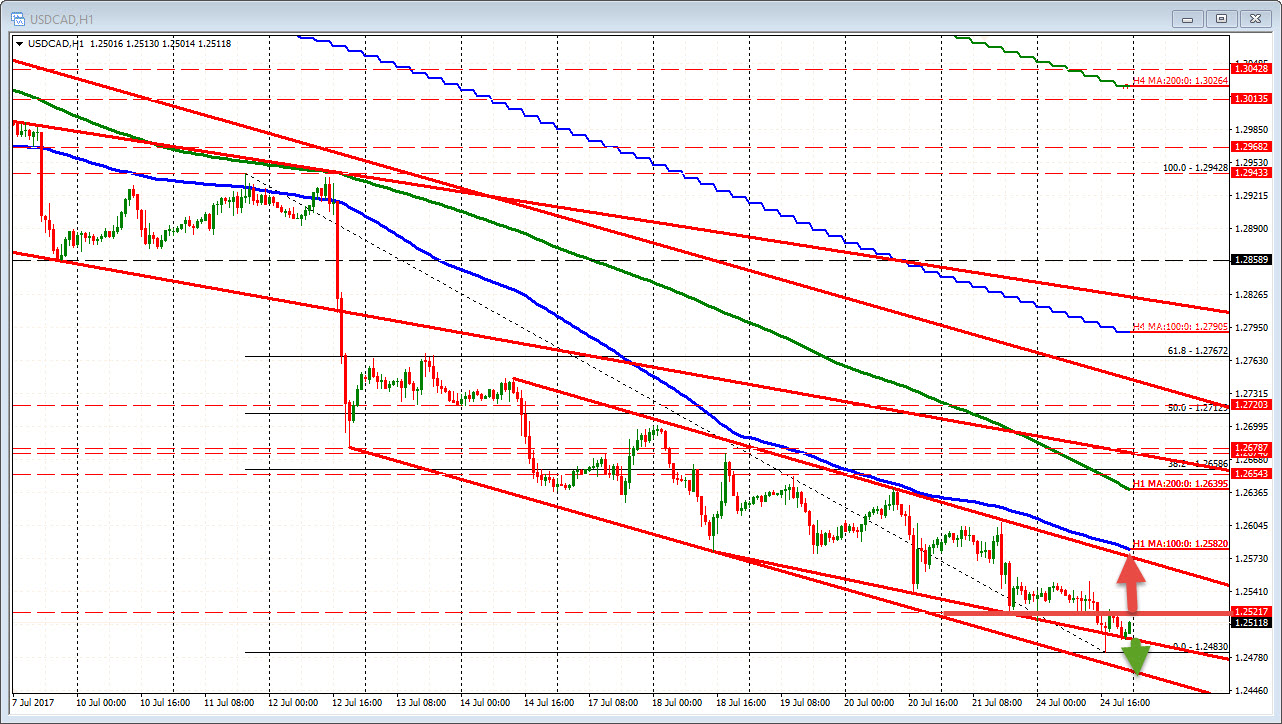

- USDCAD overstretched. So says SocGen

- European stocks end the session mixed

- Russia's oil minister: 1H results show OPEC pact effective. Crude oil higher today.

- US June existing home sales for June 5.52M vs. 5.57M estimate

- US Markit Manufacturing PMI for July 53.2 vs. 52.2 estimate

- US stocks opening mixed but little changed

- A look at the major earnings this week

- May Canada wholesale trade sales +0.9% vs +0.5% expected

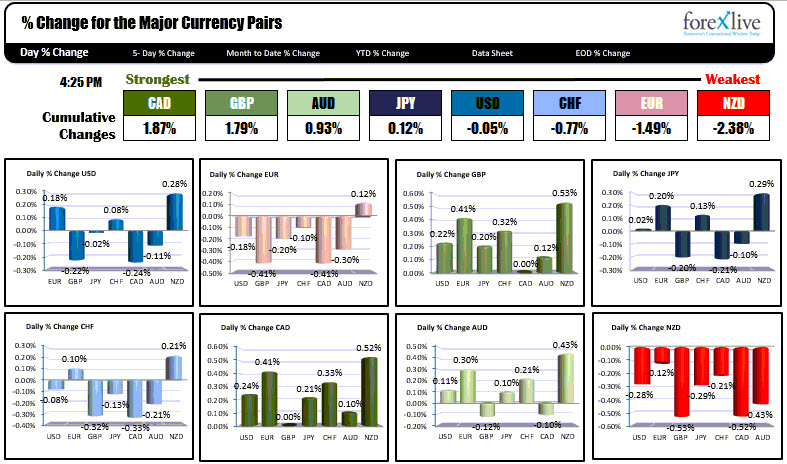

- The strongest and weakest currencies as NA traders enter for the day

An end of day snapshot of other markets show:

- Spot gold +0.38%, or+0.3%

- WTI Crude oil up $0.64 or 1.42%

- US stocks ended the day mixed. The Nasdaq closed at a record level up 0.36%. S&P fell by -0.11%. The Dow was lower by -0.31%

- US yields rose: 2 year 1.360%, +2 bp. 5 year 1.819%, +1.7 bp. 10 year 2.2535%, +1.5 bp. 30 years 2.833%, +2.4 bp

- European stocks were mixed.

The USD was mixed with modest gains vs the EUR, CHF and NZD and declines vs the GBP, CAD and AUD. The strongest currency on the day was the CAD. The weakest was the NZD.

The CAD benefited from higher oil prices and better Canada manufacturing whole sales (rose 0.9% vs +0.5%) . That helped to pressure the USDCAD to the lowest levels since May 3rd 2016, when the pair bottomed at 1.2460. The price today fell below the 1.2500 level to a low of 1.2483 but has move back up to 1.2511 near the close. The pair remains oversold, but continues to make new daily lows. In the new day, watch a move above 1.2522-24. It could lead to more upside momentum on a break higher. A move below the 1.2497 (trend line) should see a run in the new day toward the low price from 2016 (at 1.2460).

There was limited US data today. The Markit PMI indices were better with the Manufacturing index up to 53.2 vs 52.2 estimate. The service PMI was also better than expected. Later, existing home sales showed a decline from the prior month of -1.8% but the sales pace of 5.52M is still reflective of low inventory. Median prices yoy are up 6.5%.

The data had a limited impact immediately after the release. However over time there was some modest increase in the USD.

For the USDJPY, the pairs price - in the London morning session - fell below the 61.8% of the move up from the June 2016 low at 110.967, but recovered during the NY session. The pair is ending near unchanged after spending most of the day in the red. That might be indicative of a better tone in the new trading day. The 111.47 to 111.54 were swing lows from Wednesday and Thursday of last week. That may be a target in the new day. The 100 and 200 day MAs at 111.66 and 112.96 respectively would be other upside targets.

The EURUSD bottomed at 1.1624, above the support target at 1.16157. That level corresponds with the high from May 2016. Stay above that level in the new trading day is move bullish. Move below and it will be more bearish.

As mentioned above, the NZD was weakest currency on the day. For the NZDUSD the pair corrected lower from what was the highest high since September 2016. The fall saw the price retest the 200 week MA at 0.7724 (the low reached 0.7721). The price is closing at 0.7437 - above the 200 week MA level. That keeps the buyers still in control as we head into the new trading day. Stay above 0.7724 is more bullish. Move below is more bearish.

Good fortune with your trading in the new trading day.