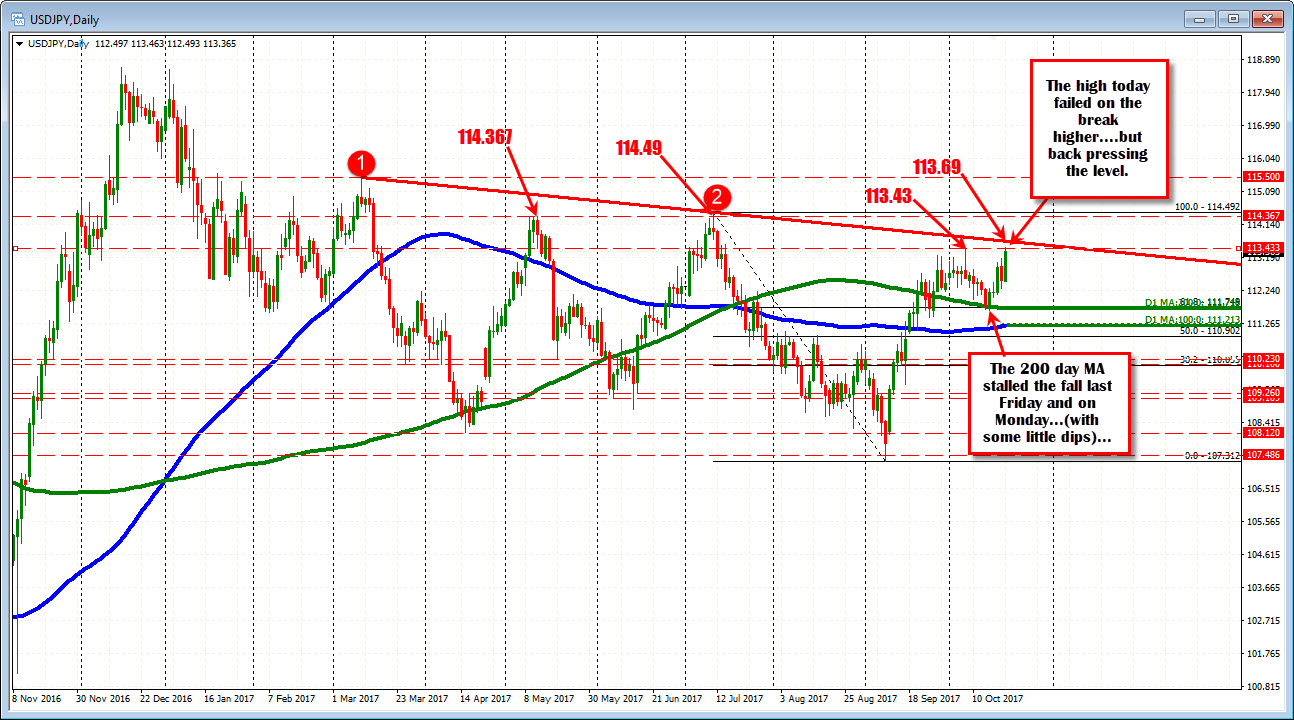

* actually took out the early October high and failed but back up near the level

The USDJPY is hanging near the early October high at 113.43. Actually, that high was taken out in trading earlier today with a print of 113.463, but the break failed. Nevertheless, the price is hanging near the level as the stocks get ready to open higher..

A topside trend line cuts across at 113.69. The May high peaked at 114.367. The July high beat that high with an extension to 114.49. Those are targets on moved higher from the daily chart.

Earlier this week (and last Friday), the pair based near the 200 day MA. The price actually fell below the MA line, but could not sustain any momentum below (see hourly chart below).

Looking at the 4-hour chart below, the pair has a topside trend line at 113.51. Get above and stay above, opens the door for more upside (more bullish)

Stocks are open now and they are opening higher. The S&P is up 6.58 points. The Dow is up about 44 points, and the Nasdaq is up about 24 points. Record intraday highs for the Dow and the S&P.

US rates are higher as well. 2 year is at 1.5681%, up 3.8 bp. 10 year is at 2.3772% up 5.9 bp. 30 year is at 2.8921% up 5.5 bp. Tax reform hope is giving rates a boost on stronger growth expectations.