November 14, 2017

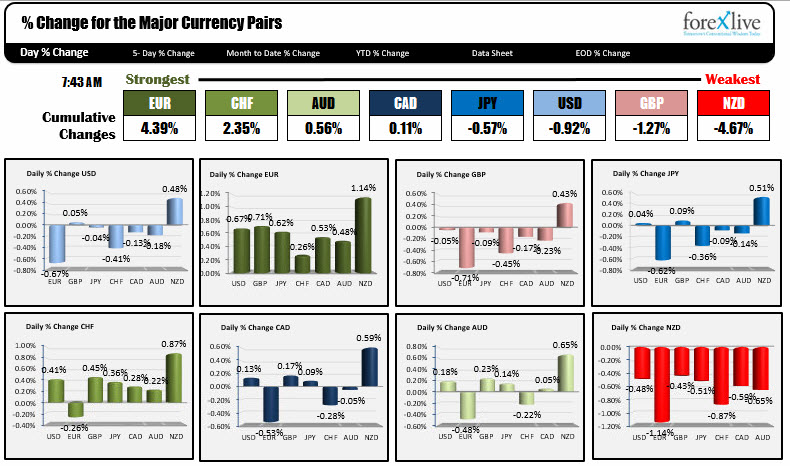

As North American traders enter for the trading day, the EUR is the strongest currency while the NZD is weakest. The USD is more down than up with most movement vs the EUR (down), NZD (up), and CHF (down).

The EUR has been on an upward shot since the early hours of the European session, and currently trades near high levels against all the major pairs.

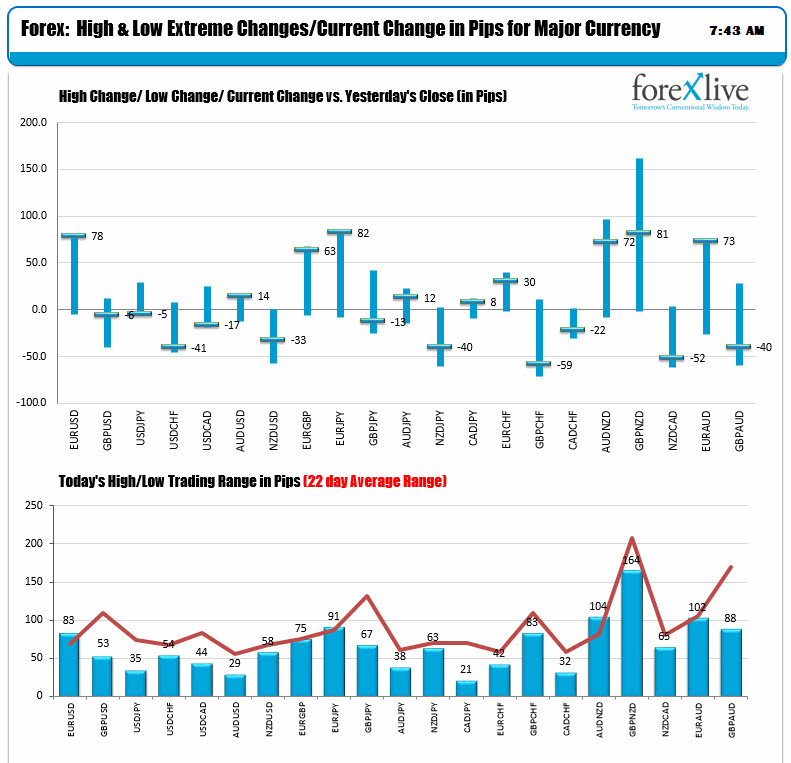

Versus the USD, the EUR is up 78 pips and has now moved above the 100 day MA at 1.1732. The pair also finally discredited the head and shoulders formation that has been keeping a lid on the pair since October 26th. The pair move back above the neckline at 1.1673 and that is when the momentum started to accelerate today.

In other markets, a snapshot shows:

- Spot gold down $2.49 or -0.19% At $1275.89

- US WTI crude oil futures are trading down $.32 or -0.56% at $56.44

- US yields are lower. Two-year yield 1.6790%, unchanged. Five-year 2.065%, minuus one basis point. 10 year 2.3859%, -2 basis points. Thirty-year 2.845%, -2.6 basis points

- US stock futures are lower in premarket trading. S&P futures are down -5.5 points. Dow futures are down -43 points. NASDAQ futures are down -7.25 points.

US PPI will be released at the bottom of the hour with the final demand expected to come in at +0.1% MoM. The ex food and energy is expected to rise by 0.2%. Year on year for the headline number is expected at 2.4% and ex food and energy expected at 2.2%