By Jen Albrecht

I do not trade on Sundays as there is no decided trend to the markets and I have not ventured into gap playing just yet so I wait till Monday to see what the markets want to do for the week before posting any potential trade setups. With that being said, I figured I'd start my first post of the week with the most important aspect of trading - managing risk. I was once told that "great traders care not about their profits but about their risk exposure", something that ALL new traders learn backwards. This is my interpretation of the sources of risk...

There are only 4 ways to lose troops (money) in the battle between the bears and the bulls, and they are as follows; Is if you...

- Enter a trade too late

- Take too large of a position

- Prematurely close adrawdown(ties into #2) (we'll touch on the specifics of a "draw down" later)

- If your technicals are inaccurate or you're just completely on the wrong side of the market (in which case... you should just stop. Everything you're doing... right now)

So let's expand these because, knowing these 4 points religiously has improved my trading mindset, tenfold. I believe the only reason new traders fail so quickly and so painfully is due to the cognitive overload of too much information. Think about it, you are brand new to the financial industry, similar to all the pioneers who moved West in hopes of "striking it rich", you've found 5 different chat rooms to join, 16 different signal services to sign up for, 7 different educational resources to invest in - you get the point, it's a f**kload of information. So naturally you sign up to all of it. You learntoo much too fastand you then proceed to input it all... at once... onto 1 chart... on a 5min time frame. I will leave the outcome to your imagination or in many of our cases, probably the horrifying scar left from when that was literally us.

Enough small talk, let's explore...

Entering a trade too late is entirely "FOMO" or the Fear Of Missing Out combined with a lack of self-control (which leads me to a side note, "self-control is the ability to not over trade and discipline is the ability to stick to your rules and trading plan" ... there's a freebie for you post-it-notes). You've just come out of the bathroom and the trade that you've been watching for the last 3 hours has now activated but you've missed your entry and its already 30 pips in profits but, you still take the trade and 5 pips later it turns around on you and you close out the trade for a loss.

Taking too large of a position is every new trader's poison, especially in the FX markets with the insane leverage offered by some brokers. I'm going to be bold enough to state - there is absolutely NO REASON TO LEVERAGE TO THE HILT, YOUR $100 OR FEW THOUSAND DOLLAR TRADING ACCOUNT BY 1000%. There. Said it. Being the "young, hip retail trader" that I am, I follow many "traders" on social media and even companies claiming they can "teach you how to trade while building a business blah blah blah" and they post, cleverly cropped out margin info, screenshots off theirmobile(Trading etiquette 101: trade on your computer, monitor on your phone. You simply cannot see enough of the charts or have access to enough trading tools on your 5inch mobile screen to accurately place trades) showing off their $800 profits within a few hours on a $250 account, trading 3 lots. Are you kidding me?! I will again, be bold enough to say, those people deserve to lose all their money and more. My other beef with this point is that a lot of what you may see is false advertising to unknowing folks considering trading the markets. Listen, trading the financial markets DOESN'T HAVE TO BE SCARY. Stressful at times, yes, but when you sitting in your bathrobe in your living room with your laptop trading, this particular stress, isn't so bad. Trading shouldn't be scary. Taking losses shouldn't even be scary. My mentor once told me "no trade (loss) on Earth, should ever #$%@ your account as long as your analysis is right". Stop trying to make $100,000 within your first week on a few hundred or even few thousand dollar accounts - it's not going to happen, so go cancel your Lamborghini test drive you have scheduled for later this week. I speak from personal experience with over leveraging my accounts because I wanted to be making a couple hundred bucks a day, right off the bat. The risk here should be fairly obvious, going back to those cleverly cropped photos I mentioned above, what you don't see is that if those trades went against those "traders" by even 5 pips, accounts are being blown left and right.TRADE YOUR ACCOUNTS ACCOURDINGLY and understand that the only reason to take too large of a position size is because you are trying to maketoo much too fast. This is a "long game" folks, not a weekend hobby - go invest if you want that. Yes, I admit, making "crumbs" for profits a day is really boring... but when those crumbs compound to make a cake - that's when the fun starts.

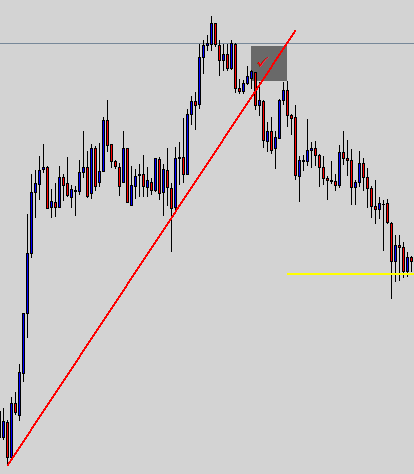

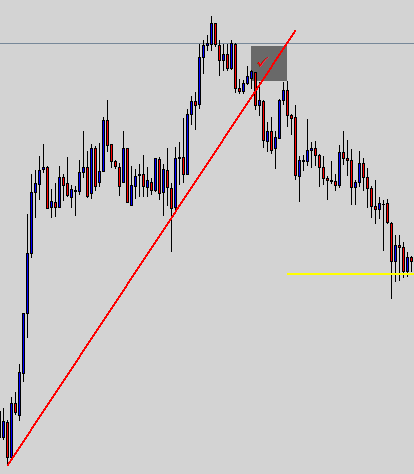

Prematurely closing a drawdown only happens when you get scared. Now, you may get scared in a trade for a many different reasons (a few of them have been listed in this post). I do tie this point into the point above as taking too large of a position size and going into a ridiculously small (literally a few pips) draw down will have you running to the bathroom. I'm just going to use my personal example to explain this one as well; when I first started trading, I thought that presuming my analysis was done correctly, the moment I placed a trade it should immediatelygo into profits and I'd start flipping tables and saying 'Hail Mary's' if it began to go against me. My mentor came along and set me straight. Draw downs in trading and inLife, are to be expected as long as your overall analysis of a trade / situation is correct.... One more time... drawdown's, or in other words, a trade going against you a bit is okay and to be expected AS LONG AS YOUR OVERALL ANALYSIS IS CORRECT. So with this being said, take a look at the photo below...

Let's break this down: this is an actual trade I took on Thursday of NZDUSD (15M chart) (demo). I took my BUY position roughly where the check mark is prior to the TL KNOWING (analysis was done) that that TL served as my "protection" to the downside and that if it broke there was 40 pips that prices had the potential to go against me till the daily pivot point (yellow line) in which they would most likely find support before recovering. Sounds good so far, I closed out my position the moment I got confirmation that that TL had broken to the downside... it was a 9 pip lose... but Jen, you just said don't flip tables over a few pips... you're right - BUT, I had taken too large of a position size on this particular trade so a 9+ pip drawdown had me running to the bathroom AND, I tried to predict the bottom of the drop which turned into "revenge trading" and everything just went downhill from there.

The learning experience: I knew that should prices break the TL they would catch themselves at the Daily PP. So had I accordingly taken a position in this trade by scaling into it, I would have kept my initial position at half its size THEN "praying for peace, preparing for war" I would have sat through the drawdown with no sweat then entered my second position after prices found their support. In case you're wondering, even if I had played this trade out properly it still would've been a loss as prices never fully recovered but I would have been able to come close to breakeven. The main point...a trade is ONLY a loss when you close it as one.

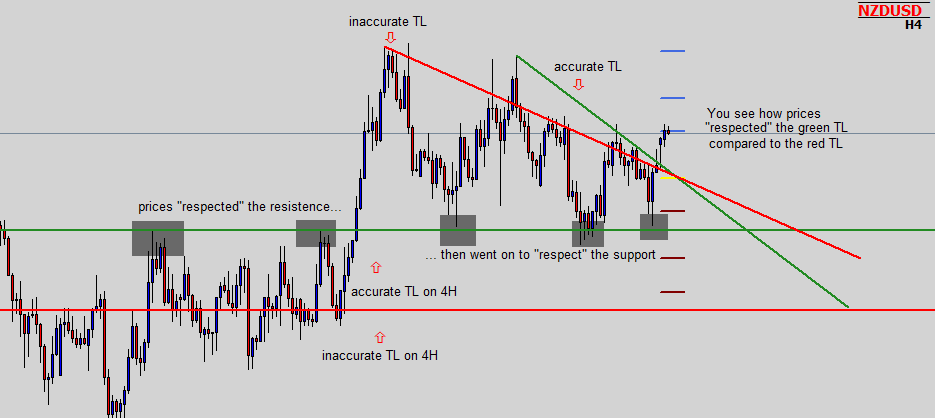

Inaccurate technicals / playing the wrong side of the markets. Firstly, playing the wrong side of the markets needs no explanations... it's literally "trading 1 of trading 101". You sit down to your trading terminal, pull up a chart and then identify the direction of the market. Inaccurate technical's is probably the lowest risk inducing factor here as it is extremely subjective. I'll keep this point to an example as I'm sure you'll be quick to understand what this means. Example, I draw my trend lines - wick to body (that's how my mentor taught me). I know others who draw them wick to wick. I know some sources will say - body to body. So, "inaccurate technical's" really just depends on the degree of inaccuracy and that is something that you will need to fine tune with every trade you take. How do you know when your technical are fairly accurate? Look for confluence zones and look for prices "respecting" your technical's (support& resistance levels, fibs, trend lines etc.) Also, if you do take a loss due to inaccurate technical's, after the fact, you'll be pretty quick to spot where you went wrong and tweak it for your next trade.

(Below is a picture of accurate vs. inaccurate technical's - again, remember, for the most part - subjective but you can clearly tell when some technical's just aren't accurate no matter how you view the charts)

And that's a wrap folks. These points above are what I believe to be the sources of risk while trading. Once I really broke these down for myself and analyzed trades that I'd lost, I was able to put so much clarity behind my trading. To tie in my opening quote, the only money you can lose to the markets is money you allow the markets to take, be it you not doing your due diligence on a trade, trading too large, being greedy, you name it. As much as people like to say the markets are unpredictable blah blah blah, you have complete control over your trades and when you really let that sink into your trading mindset, your trading becomes a beautiful thing. I hope that you find this article informative as you start your new trading week or even just amusing as I leave you with this: Think about your last loss, I would be very curious to hear from you, if itdidn'tfall into 1 or more of my 4 points above.

Tomorrow, once the markets have settled I will come with some trade set ups.

Enjoy & happy pip hunting!