By Boris Schlossberg at BKForex

Most trading gurus tell you to ignore the fundamentals and focus on the technicals. Almost every trading book you pick up is filled with technical patterns, indicator glossaries and a multitude of strategies based on the combination of both. Most retail traders can expound on differences between MACD and RSI, but would be stumped by the meaning of PMI reports or the IFO survey.

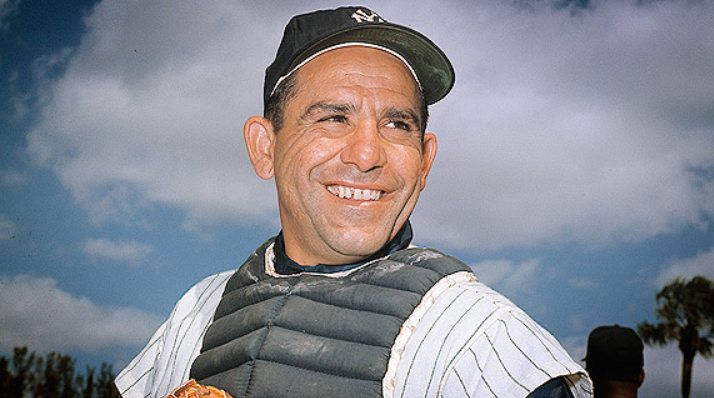

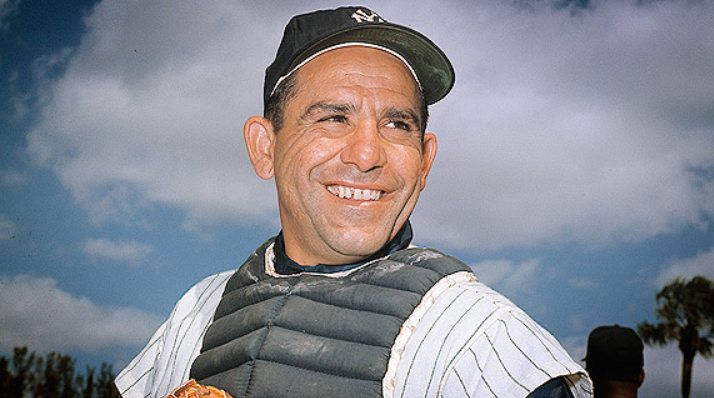

I understand. Fundamentals are hard. They are confusing and often contradictory. In the inimitable words of Yogi Berra (pictured above), "It's tough to make predictions, especially about the future" -- and especially if those predictions involve some long-term view on the economy, which can change faster than the weather in Florida.

Fundamentals are fickle. They require context, which often only becomes obvious after the fact. And they certainly appear less objective than a couple of trend lines on a chart.

But here is what I don't understand. I don't understand retail traders (most specifically day traders) who tell me with a straight face. "I don't care about news."

Those have to be the five stupidest words that I hear every single day.

What do you think moves price? Only two things. Price itself and News. So if you just watching price and not following the news you are like a half blind man competing against thousands of traders with eagle eye vision. Is there any wonder why 90% of retail traders lose money? Without any awareness of the news retail traders are simply fodder for the market. They are the quintessence of "dumb money".

I can't tell you how many times I've seen retail traders lay down a bet on some cross like EUR/NZD because "it looked good on a chart" 3 minutes before an RBNZ announcement or an employment report only to see their money evaporate before their eyes.

Here are some simple rules for retail traders. If you know the difference between RSI and ADX, but can't tell me the name of every single leader of a G-20 central bank -- you are patsy.

If you love Fibonacci and can wax poetic about Elliott Wave, but have no clue as to what time of the day UK data generally comes out -- you are a HUGE patsy.

If you think that that brand new tweak to your MACD settings is the key to your future success, but you have no idea of who Taro Aso is I got news for you. That USD/JPY trade you been holding will blow up in you face worse than a bowl marinara set on microwave setting of high. In fact, 90% of all retail traders would be much better off if they knew NOTHING about technical indicators, but knew the weekly G-20 economic calendar COLD.

To trade with Boris at BKForex, join the BK Trading Room.

Also see Greg Michalowski's video on the 5 smartest words retail traders say.