What's the impact on the dollar? I am not so sure

AUTHORS NOTE: Although I am more of a technical trader, than I am a fundamental trader, it is still human nature to put the pieces of the fundamental story together. In this post, it is not so much a step-by-step "How to..." guide, but a view on how drilling down fundamentally may end up not answering any questions on what you should think or feel in your trading. And that is ok.

------------------------------------------------------------------------------------------

There are a lot of balls in the air with the Fed, China, commodities including oil and stocks. The concoction makes for a currency market that is left wondering what to expect.

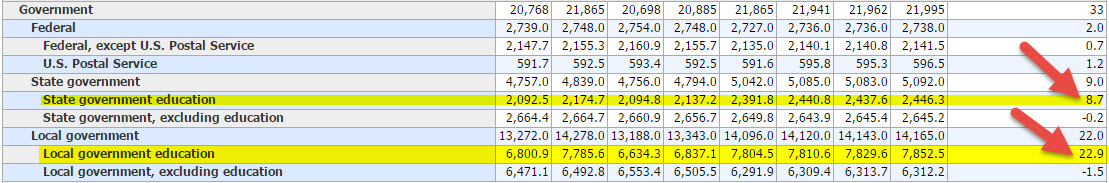

Fed: The Fed is squarely painted in the corner. 5.1% unemployment. NFP weaker at 173K vs 217K (revision was higher though), but Government adding 33K local and state teachers. Without those jobs teacher jobs imagine what might have happened? Can you blame it on seasonals being off? Don't they they adjust seasonals? I don't know ... but it would make sense to me that seasonals are intended to take seasonals flows into effect.

On the surface, the NFP change along with the revision and unemployment rate is enough for an antsy Fed to pull the trigger if they want to avoid the other stuff (like China, oil , commodities, stocks) . If the Fed tightens the dollar should go higher but if they tighten and the dollar goes higher, and earnings continue to stink and stock market does not like it.Then we have China and the US sucking wind. That is what the Fed is sleeping on between now and Sept 17th.

China: China reminds me a bit of the argument that housing was only a small percentage of the US economy back in 2008. Therefore it is not important? It is the 2nd largest economy in the world. So it does has an impact.

The old growth in China was from an unsustainable infrastructure standpoint. That growth just could not be sustained. The environment was deteriorating. With 1.4 billion people who rely on drinking water, eating fish, breathing air, all at risk, that is not a good long term thing. It had to change. Solution: Transition to service/consumption economy. That takes time. It comes at an expense. Jobs have to be redistributed. How do you keep up spending? What impact does the transition have on global economy?

The price of iron ore shows an impact...A big impact. This has effected countries like Australia. That's a big move.

The price of commodities in general are of course way down. That has an impact on commodity producers.

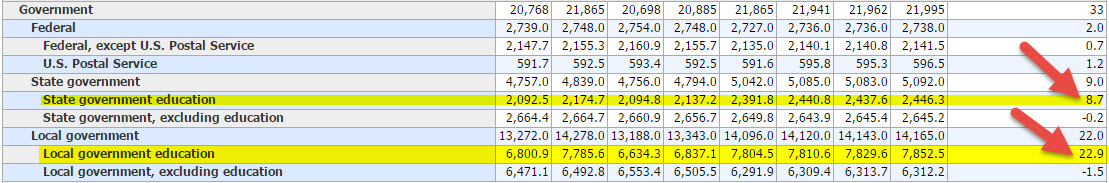

If the plan was to stimulate domestic demand, a stronger domestic stock market would have been beneficial. That plan backfired. Mom and pop were invited to join in the soaring stock markets as the market soared this year. You remember the stories in the news not too long ago.

This is the result. The Shanghai index is trading down on the year now and is back at 2010 high levels.

Looking at the year, the index was up 59% at one point. Now it is down -2.3%.

That hurts.

The tech heavy Shenzhen stock exchange was up 126% on the year at one point (see chart below). It is still up (by 17% or so) but most were sucked in on the way up and suffered on the way down.

Oil: Too high oil price is not great. Too low oil is not all that great either. The US was creating it's own supply and that was good times. Texas and Fed's Fischer loved it (being Dallas Fed Chairman). Now the oil good times are not as great in Texas

OPEC did not like the competition from the US. So supply /production goes up, inventories are filled up and there is a glut. The chart on the DOE Crude oil inventories rise below shows the unprecedented rise.

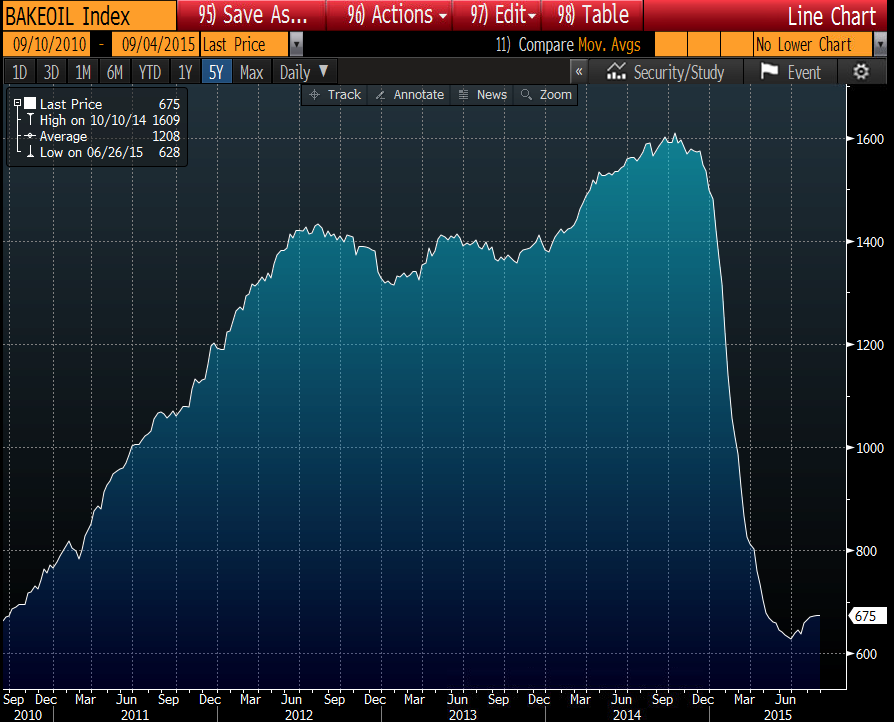

Oil prices go down (see chart below)

From the chart above the inventories are starting to come down, but remain at near elevated levels. This is also a seasonally dip time for inventories. Inventories tend to rise after the Labor day holiday. They are already high. HMMM.

Meanwhile, mining jobs (high paying - include oil and exploration and coal) in the US have been on the downswing as the chart below shows.

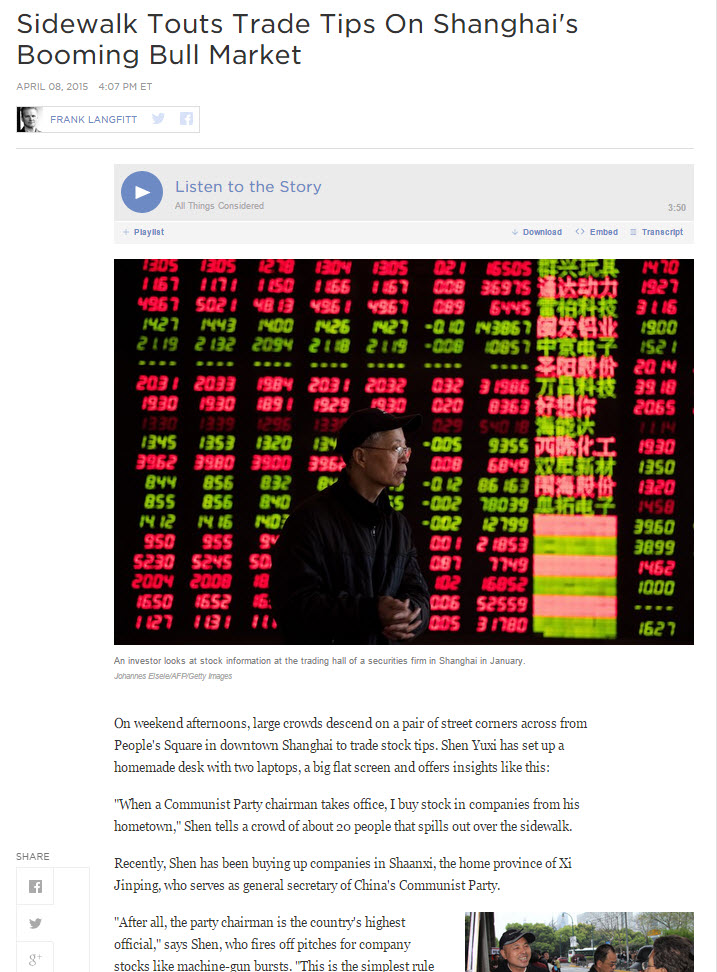

The Baker Hughes rig counts plummeted in the US. They are back to where it started. It is not profitable (or as profitable) anymore.

Is lower oil prices good. It keeps inflation low (as does commodities). It is positive for business who have lower cost of production. But it can hurt too.

Stocks: The S&P 5 year chart you cannot complain about. It is up sharply since 2011, but it is now running away from the MAs. It also broke trend line support, corrected up to it and fell back lower. The low from October 2014 was tested and held at 1867 area. Key level going forward. A move below and the 38.2% line is the next target.

This was to be the year of the German Dax with QE in the ECB. Indeed the price surged higher and was up 26%. However, much of those gains are gone. The Dax is up 2.37% on the year (down 2.71% today) and it did hold trend line support and the 38.2% retracement (see chart below). Like the S&P it is a break of support away from more technical damage.

The point is that when you look at it, there are a lot of assets that are down. The 2nd largest economy is transitioning and it has had an impact. Will it do more damage?

Corrections are good if they are relatively shallow. Commodities are not in a shallow correction. The stock markets are teetering on not being shallow. The Fed has a big dilemma ahead of them. That decision might be to look at the above and not do anything again. Does that help? If they don't do anything, we will certainly get a clue from the stock market reaction. The Pavlovian reaction has always been, buy stocks. Will the money flow back into stocks.

As far as forex/the dollar, I really am stuck from a fundamental perspective. I am not sure you can put a true finger on it. The technical price action will need to be eyed for clues and to define and limit risk. Without it, you may find yourself lost.