Australian Labour Market Report for September

The headline is Employment Change:

- expected 15.0K, prior 54.2K

Unemployment Rate:

- expected 5.6%, prior 5.6%

Full Time Employment Change:

- prior was +40.1K

Part Time Employment Change:

- prior was +14.1K

Participation Rate:

- expected is 65.2%, prior was 65.3%

These are the 'seasonally adjusted', which is what is reported immediately and captures the attention of the market. The 'trend' data is what the Australian Bureau of Statistics tells us to look at, but no-one cares what they say! I pop the 'trend' data up immediately following the sa figures anyway.

A good report should be supportive for the Australian dollar, but attention will shift to China (data and Congress) pretty soon after).

--

Previews:

ANZ:

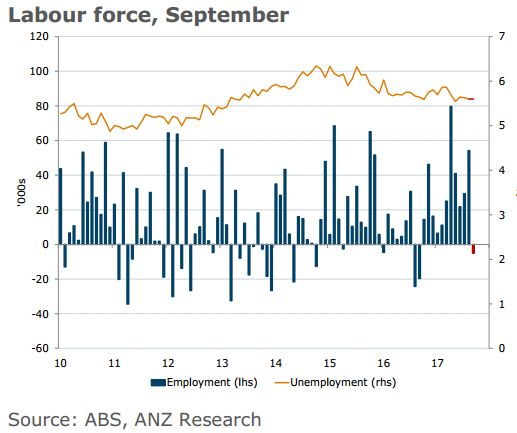

- We expect employment to have fallen 5k in September. This fall follows a very strong gain in August of 54k, which itself built on a 29k rise in July.

- While the business surveys suggest the labour market remains solid, some statistical payback seems in order. Moreover, September data have had a tendency to disappoint, with an average fall of 12k over the past four years.

- We expect the unemployment rate to remain unchanged at 5.6%.

CBA:

- The Australian labour market has improved markedly over 2017.

- There have been six strong monthly employment reports in a row.

- The improvement is evident in a range of labour market indicators and it has been broad-based across all states.

- We expect to see another decent report in September, consistent with the forward looking indicators.

- Our forecast is for a lift in jobs of 20k over September which would take the unemployment rate down to 5.5% on a slight fall in the participation rate.

Westpac:

- Total employment rose 54.2k in August compared the market's for +20k. Full-time employment bounced 54.2k following a -19.9k correction in Jul. In the year full-time employment has gained 251.2k/3.0%yr. Part-time employment rose 14.1k following a 49.1k bounce in Jul. In the year to Aug, part-time employment lifted 74.5k/2.0%yr.

- By state, NSW, Vic and Qld were driving the strength with total employment gaining 12.9k, 18.6k and 16.7k respectively.

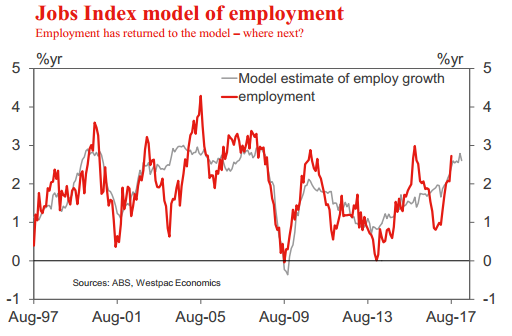

- The leading indicator including our preferred Jobs Index all point to ongoing robust demand for labour. We are also looking for annual growth in employment to overshoot the Index through late 2017 and into early 2018 as it rebounds from an undershoot during late 2016 early 2017. Our forecast 25k rise in employment will lift the annual rate to 3.1%yr from 2.7%yr.

- Despite the strong gain in employment, the Aug release printed a flat unemployment rate of 5.6% (5.60% at two decimal places) due to a 0.2ppt gain in the participation rate driving a solid rise the labour force.

- In Aug, the gain in participation came from a lift in both male and female participation but the gains from females have been somewhat greater and females do appear to be on a more solid uptrend. Males, by contrast, look more like they have found some stability in participation. By state, the strongest gains in female participation were in Qld but they are also improving in NSW while Vic continues to hold a very high level of female participation.

- In Sep, we are looking for a flat participation rate of 65.3% which will generate a 30.5k gain in the labour force which, with rounding, will leave the unemployment rate at 5.6%.

TD Securities:

- The outsized Aug +54k defied all seasonal analysis (as has employment all year ...).

- We look for a -5k correction, which in no way dents the superb performance from the labour market this year, although may lift the unemployment rate to 5.7%. Market equally confused, the range a breathtaking -10k to +32k.

RBC:

- We are looking for strength to continue as leading indicators including job vacancies, job ads, and the NAB business survey all point to another month of robust jobs growth, but our +15k forecast reflects some risk of a statistical correction. This, nevertheless, still leaves the underlying trend strong.

- After dispensing with temporary period of weakness earlier in the year, the labour market has looked very solid, with unemployment resuming its steady fall from mid-2015 highs of 6.3%. Last month saw another strong result with a +54.2k headline increase in jobs for the month and strength in the detail, with unemployment managing to hold steady at 5.6% despite the participation rate rising to 65.3%, the highest level since 2012.

- As we have previously noted, the RBA has also been sounding increasingly positive on the labour market in recent commentaries. We look for the unemployment rate to hold steady at 5.6% in September.