Business confidence 7 for Q3

- prior 8, revised from 7

The report came out at the same time as the employment report, which was the focus. Catching up now!

Summary via NAB (bolding mine):

The quarterly NAB Business Survey gives a more in-depth probe into the conditions facing Australian business than the monthly survey, and also provides extra information about how firms perceive the outlook for their respective industries.

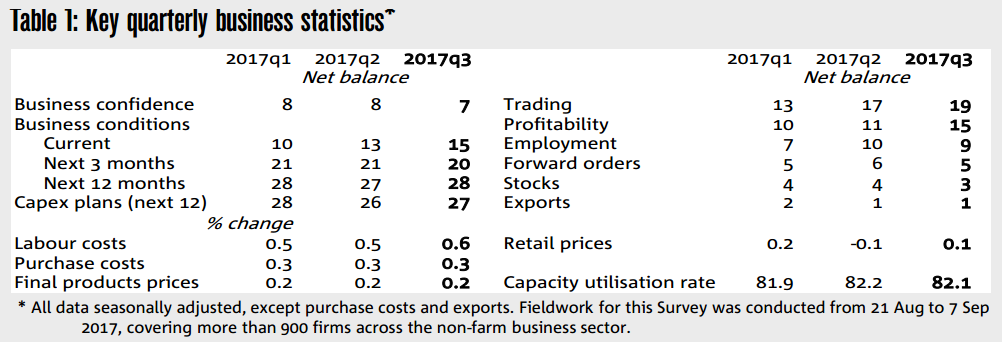

Business conditions (an average of trading conditions/sales, profitability and employment) improved again in Q3, driven by a lift in trading conditions and profitability.

- Employment conditions fell slightly, but are still at solid levels.

- Most industries reported positive business conditions, although wholesale and retail both deteriorated sharply, with retail sales dropping back to negative levels.

Business conditions rose to +15 in Q3, which is well above the long run average of +1 and is its highest level since early 2008

- That indicates a growing divergence away from business confidence (at +7, which is only slightly above the long-run average), which might help to explain why firms are not investing as much as expected under these conditions.

We have recently started asking firms about what factors have had the biggest impact on their confidence, and for those indicating a deterioration in confidence, margin pressure, the demand outlook, government policy and costs (energy and wages) are all having a major impact

Meanwhile, most leading indicators saw only minor changes in Q3, but are generally holding at levels that suggest continued expansion in the next 12 months.

- Forward orders eased a little, as did expectations for business conditions in the next 3 months.

- However, the longer-term outlook (next 12 months) for conditions lifted from already very elevated levels.

- The capacity utilisation rate was down slightly (at 82.1% compared with long-run average of 80.6%), but still bodes well for labour demand and future capital expenditure.

- Consistent with that, both employment expectations and capex plans (next 12 months) strengthened.

- Aside from better employment conditions, a lift in labour costs (a wage bill measure) also points to a tighter labour market.

- In addition, significantly more firms indicated that it is more difficult to find suitable labour than it was a year ago - an indicator which tends to be highly correlated with the unemployment rate

residential construction conditions rose further, despite concerns about oversupply

- non-residential conditions remained relatively strong despite easing back in the quarter

More firms indicated that they were comfortable with the current level of the AUD, compared to the previous quarter, despite the fact that the Survey was conducted when the AUD averaged $US 0.79 (near 5 cents higher that the previous Survey)

The Survey is suggesting subdued inflationary pressures, but labour costs (a wage bill measure) are slowly strengthening - potentially putting added pressure on margins (the Survey's margins index remained negative). Product price inflation was relatively subdued, at an annualised rate of 0.9%, while retail inflation remains soft despite utility price rises