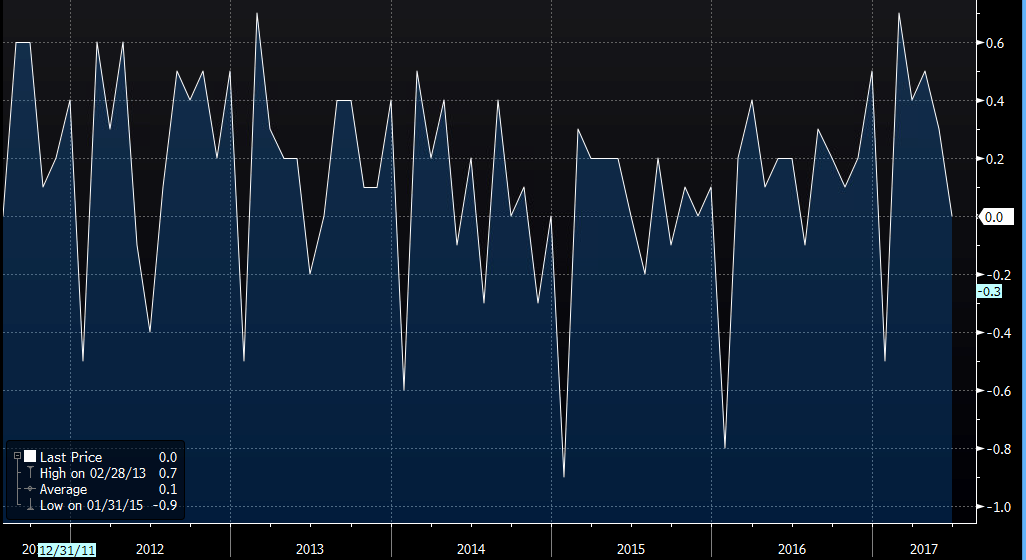

UK June inflation data now out 18 July

- 0.3% prev

- yy 2.6% vs 2.7% exp/prev

- core CPI yy 2.4% vs 2.6% exp/prev

- CPIH yy 2.6% vs 2.7% exp/prev

- RPI mm 0.2% vs 0.4% exp/prev

- yy 3.5% vs 3.6% exp vs 3.7% prev

- RPI ex mortgage payments yy 3.8% as exp vs 3.9% prev

- PPI input NSA mm -0.4% vs -0.9% exp/prev

- yy 9.9% vs 9.4% exp vs 12.1% prev

- PPI output NSA mm 0.0% vs 0.1% exp/prev

- yy 3.3% vs 3.4% exp/prev

- HPI May yy 4.7% vs 3.0% exp vs 5.3% prev revised down from 5.6%

Bingo , the leak was right. Softer data and GBPUSD breaks down through 1.3050 and posts 1.3025 as I type. EURGBP 0.8846

GBP sell-side the weak side again but expect demand between 1.3000-20 and EURGBP supply around 0.8850.

Say the ONS:

- Falling prices for motor fuels and certain recreational and cultural goods and services were the main contributors to the fall in the rate.

- These downward contributions were partially offset by rising prices for furniture and furnishings.

- The CPIH inflation rate fell for the first time since April 2016, but remains higher than in recent years

- Transport continued to make a large contribution to the CPIH inflation rate in June 2017, although this has lessened in recent months

- Falling motor fuel prices contributed most to the fall in the CPIH 12-month rate between May and June 2017