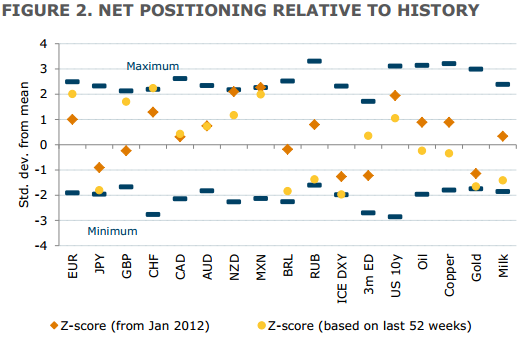

This via Société Générale on EUR/USD and what positioning data from the CFTC report is indicating:

- CFTC positioning data suggest that speculators are long the euro

- ... The inability of 10year US yields to get back above 2.40% and the willingness of speculators to go long even as yields fall back below their 2017 average, is what keeps the 10year Treasury/Bund spread at multi-month lows and EUR/USD bid.

- ... what seem stretched positions in both bonds and FX, can really take EUR/USD on upwards without some kind of correction?

- The main focus will be on Thursday's ECB meeting and everyone (as far as I can tell) expects the focus to be on the lack of inflation rather than the case for further tapering of the ECB's bond purchases. There's clearly some reluctance to rock the boat (both in bond and currency markets) at the start of the summer break.

- That leaves us with EUR/USD 1.1620 as the next technical target, while on the downside 1.13 is the key support.

- Recent experience suggests we won't get to the support line and will just mess about in this range before pushing higher again

--

Good question re the stretched positioning in EUR. Yesterday I posted this from ANZ as part of this post: ANZ on CFTC data - "overall net USD longs to their lowest since May 2016"

In this assessment (ANZ look at the CFTC report a little differently - see the post for details) its not EWUR that seems most stretched.