Forex headlines for North American trading on Sept 4, 2017

- Not a great start for stocks in the holiday shortened week

- Crude oil is closing sharply higher in trading today

- Feds Kashkari LIVE at the University of Minnesota

- Stocks extend the slide. Nasdaq and Dow down 1%.

- ECB poses two-way risks for EUR/USD on Thursday - Barclays

- European stocks markets finish mostly lower

- Sessions to announce termination of DACA

- US dollar falls to fresh lows across the board. Here's why

- New Zealand GDT price index +0.3%

- July US factory orders -3.3% vs -3.3% expected

- ISM New York business conditions 56.6 vs 62.8 prior

- Oil nears the late-August highs as Irma gains strength. Orange juice jumps

- Bonds are flashing more worries than the equity market

- Fed's Brainard: Bond runoff will be on 'autopilot' unless there are large adverse developments

- Trump says US will allow Japan and South Korea to buy more sophisticated US military equipment

- Hurricane Irma is now a Category 5 storm

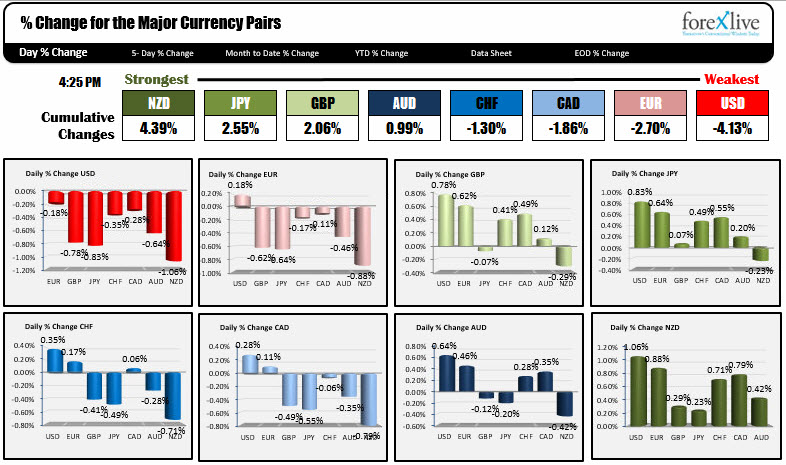

- The AUD is the strongest and the CHF is the weakest as NA trader enter for day

- US Fed's Brainard says it may be prudent to raise rates more gradually than median forecast

A snapshot of the other markets outside the forex sphere shows:

- Gold up $7.68 or 0.58% to $1340.04. Last week the price of gold moved above the $1300 level and the price action has kept the upside momentum going

- WTI crude oil is up $1.24 or 2.62% to $48.53 currently. Refineries are reopened and a new hurricane Irma were big impacts on the price today

- US stocks got off to a down start to the week. The S&P was down -0.76%. The Nasdaq was down -0.93% and the Dow was down -1.07%

- US yields were sharply lower and a big catalyst for the dollar today. 2 year 1.29%, -5.2 bp. 10 year 2.0613%, down 10.4 bp 30 year 2.6806%, -9.6 bp

The USD was the dog today, falling against all the major currency pairs. Below is a snapshot of the % changes of the major pairs vs each other. The USD fell the most against the NZD, JPY and the GBP. Its fall against the EUR and CAD were more modest - but still down.

Catalysts for the decline include:

- Higher gold. Gold increased on the back of No. Korean tensions. Higher gold tends to weaken the dollar,

- Higher oil. If oil goes up it can depress the dollar (and visa versa). Oil was higher on refineries coming back up in Houston, Saudi/Russia talk about production cuts sticking, potential disruptions from Hurricane Irma which is barreling toward southern Florida and may scoot into the Gulf.

- Factory orders declined by -3.3%. That was as expected (after a +3.2% increase) and the ex transportation was higher at 0.6%

- Stocks dropped which can weaken the dollar at times

The largest catalyst was sharply lower US yields. The 10 year yield in the US fell to the lowest level since November 10, 2016, and eyes a test of the 2.0% level. Why are yields lower?

- No Korea tensions led to a flight into the relative safety of the US treasuries

- The FOMC governor Lael Brainard was more dovisih in her comments today saying that the Fed should make it clear it is comfortable with pushing inflation "modestly above target for a time"

- Neel Kashkari was also his usual dovish self going so far as suggesting the Fed may have slowed the economy down with their tightenings.

Those are the types of comments to send yields lower and the dollar lower with it.

Some technical levels to eye:

- The NZDUSD was the strongest currency pair today, but it ran into the a topside trend line that stalled the rally (see chart below). That trend line will be eyed in the new trading day.

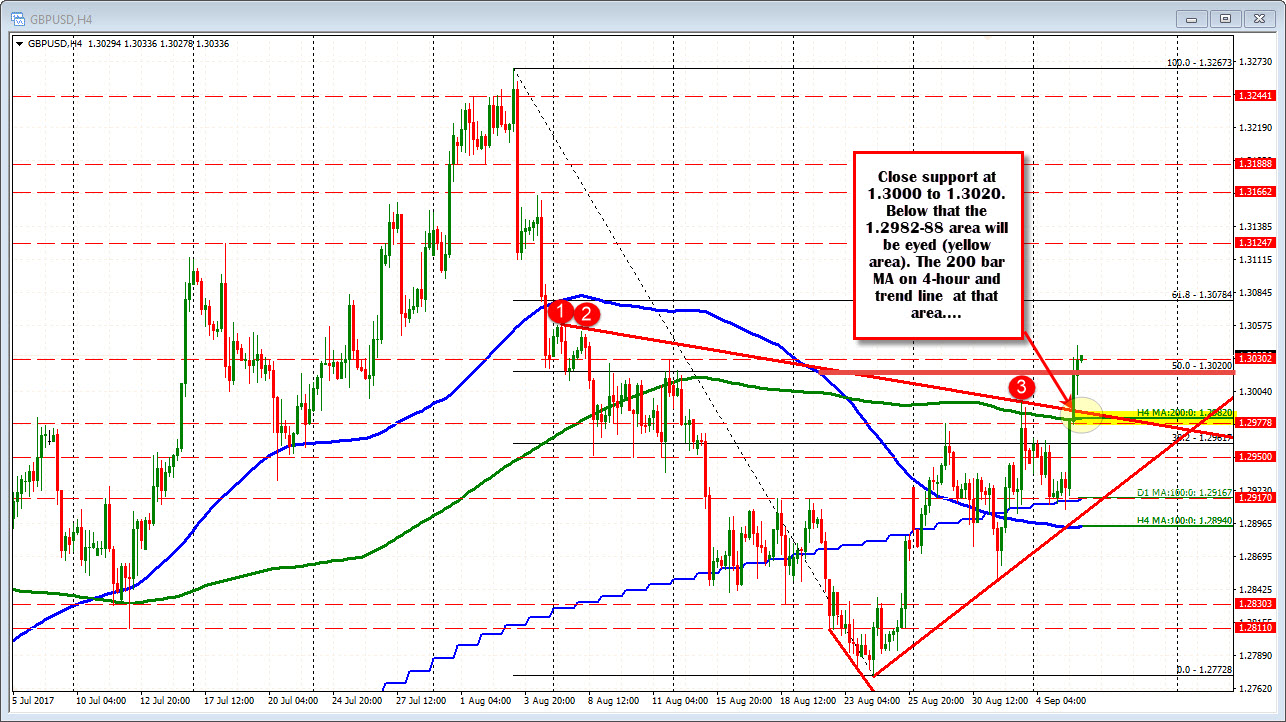

- The GBPUSD moved above 200 bar MA on the 4-hour chart and a trend line at the 1.2982-88 area. The price has also moved and is closing above the 1.3000 and the 50% at 1.3020 (see chart below). The 1.3000-1.3020 is close support in the new trading day. More patient support comes in at 1.2982-88.

- The USDJPY moved above the channel trend line but could not get above the 100 bar MA on the 5-minute chart. The 108.64 area is getting stronger as a floor. That floor can be broken and made a ceiling OR does the price bounce and get above the 100 bar MA (blue line below) and work next on the 200 bar MA (green line)?

Good fortune with your trading traders.